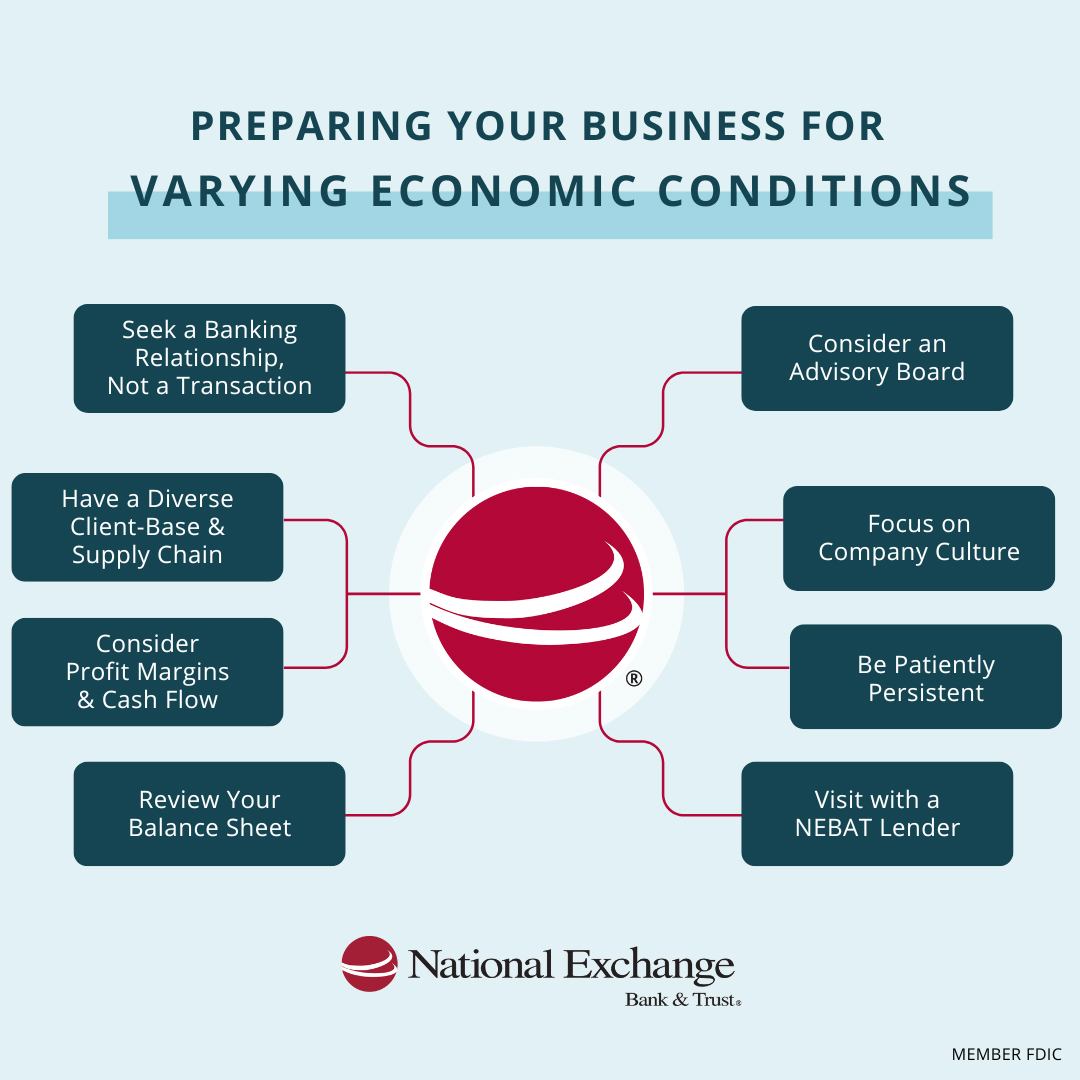

7 Pieces of Business Advice for Any Challenge

As a business owner, you know that anything can happen at any time - supply chain issues, recruitment concerns, even recessions. At NEBAT, we have experienced the largest fluctuations in the economy alongside our business partners and have put together some business advice to prepare your business for whatever comes your way.

1. Seek a Banking Relationship, Not a Quick Transaction

Having a banking partner that knows the ins and outs of your business will provide invaluable insight during difficult decision-making times. Another bank could provide you a quick loan transaction, but you want a partner that will get to know your business on a deeper level. At NEBAT, we want to know your value propositions and your business goals, ultimately helping guide you to prepare your business for anything. These relationships truly pay off when you’re looking for both financial and business advice. Then, when you are in need of a loan, line of credit, or other financial products, we can point you in the right direction quickly.

You’ll hear from us not just out of obligation, but to really know your business. During these in-person meetings, we learn about what’s going well or current struggles. We can offer our expertise, or provide key introductions if opportunities present themselves. Since we work with many businesses in the area, we can provide connections between businesses including attorneys, CPAs, manufacturers and more.

2. Have a Diverse Client-Base & Supply Chain

You know your customer base really well, but is there any chance that putting all your eggs in one basket could be holding you back? If a change in the economy impacts your current client base, are you diversified enough to keep YOUR business afloat? Preparing your business for a recession could mean expanding your business to new markets.

Similarly, look at your supply chain. Do you have various options available if you need to promptly switch suppliers? Your business may be doing all it can to keep up with demand, but some things are beyond your control. Start seeking out new suppliers now so you can be prepared later.

3. Consider Profit-Margins and Cash Flow

This one should really speak for itself, but we can’t go without mentioning this piece of business advice. During tough times, you need to support your customer where you can, but you cannot sacrifice your own existence. Interestingly enough, during economic events, your customers almost expect price changes. During “normal” times, they may be taken back by a price increase since they aren’t expecting it; they may be wondering why prices are changing. Bring your accountant in for a discussion to make sure you’re in a sweet spot and be ready to adjust if you need to.

4. Review Your Balance Sheet

Remember that banks will review your cost of inventory when determining your eligibility for a loan or line of credit. You may choose to run leaner on inventory to make sure you’re not stuck in a bind.

Another item to pay attention to is your accounts receivables. Hold your customers accountable for paying on time and in accordance with their payment terms, as this could pose an issue if you’re looking for a loan. You may not need a bigger line of credit if you received payments in a timely fashion.

5. Consider an Advisory Board

When business owners are in the thick of it, it’s hard to think outside the box and remain strategic. During difficult times, you are going from one fire to the next on a daily basis, all while trying to keep your business afloat. It’s difficult to take a step back to truly be strategic. Having a third-party advisory board can help you be strategic, hold you accountable, and stick to your business goals, even during a crisis. Your team looks to YOU to be the leader of the company, and sometimes, you need someone you can look to for guidance as well. Your NEBAT business lender could offer suggestions for your advisory board too!

6. Company Culture

Yes, this matters for your bottom line. Your customers can pick out disengaged employees easier than you may think. How do you get your team engaged to really work for a common purpose to take care of your customers and grow your company? Your employees are the ones keeping your customers coming back, so keeping employees happy will mean happy, long-term customers.

Not only do you want to keep employees for your customers, but it is incredibly costly for a company when there is high turnover. Needless to say, get the right people in your door, and empower them to do the right things.

7. “Patiently Persistent”

Be patient about how you go about your day. Not everything needs to be responded to immediately, in fact, if you give it some thought you may respond better and more effectively instead of responding to it with emotion. If possible, wait 24 hours before handling the situation.

At the same time, be persistent and have good discipline to keep the pace. Remain dedicated to your goals and remember why you’re in business. If you can balance patience while being persistent, you’ll be able to lead your company through even the toughest challenges.