Tax Season Reminder

Paper checks are no longer being issued for tax refunds. Learn what steps to take to ensure your refund arrives quickly and securely in our recent blog.

The hustle and bustle of the end of the year, with its holiday cheer, can be stressful - not to mention the added stress on our pocketbooks. Financial stress can be consuming and make a significant impact on your mental health and overall wellbeing. From mounting debts to unexpected bills and buying gifts to planning for the future, it can be overwhelming. Practicing a little financial stress management can help lead you in the right direction and help you regain control of your finances. When you control and understand your finances, you can lower your financial stress levels. Let’s take a deep breath and dive into some practical tips that you can put into play for your New Year’s resolution.

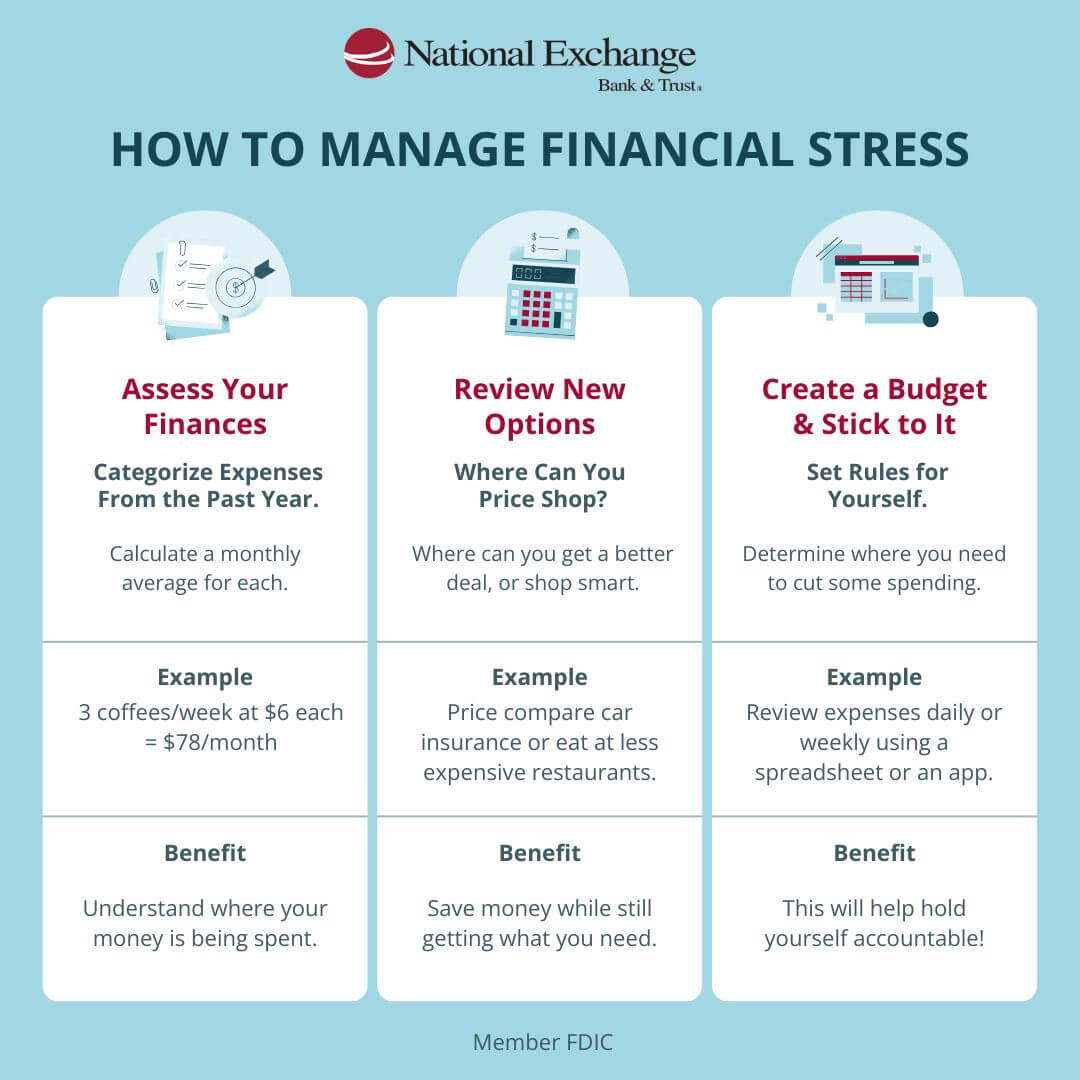

The first step of financial stress management is to review how you’re currently spending your money. We recommend looking at all expenses from the past year. Pull up your online bank accounts, credit card statements, and any cash apps you use and categorize your expenses. Categories for this could be insurance, utility bills, mortgage/rent, eating out, coffee, shopping, gas, gifts, subscriptions, etc. You’ll then want to see how much you’ve spent in each category over the past year. From there you can average out that number to see on average how much you spend each month.

For example, if you buy 3 coffees each week at $6 each, that’s $936 a year on coffee. So, your average per month would be $936 / 12 = $78. Doing this for each category will help you determine where your money is most spent. This simple exercise may even open your eyes to where you could cut back and save!

The next step is looking at what categories you could price-shop for. Things like car insurance, homeowners/renters insurance are expenses you may be able to find a better deal on.

For smaller line items, there are other ways to cut expenses. For example, eating out at less expensive restaurants, exploring the cheapest gas stations in your area, taking a longer time to consider a purchase or price-shopping a bit, and more. Get creative and take into consideration all of your needs and wants.

Then of course, review where you don’t necessarily NEED to spend money. Maybe you don’t need to eat out anymore and could be better about cooking at home. Then you can save eating out for special occasions, like a treat to yourself for hitting a financial goal.

Managing financial stress takes time, effort, and commitment. This is not a skill anyone is born with; it needs to be learned and practiced. One great way to do this is to create a budget. At this point you’ll know where you spend money the most and what it costs you on average. Set yourself a realistic budget for each category each month and stick with it! Using a spreadsheet or an app, do daily or weekly check-ins to hold yourself accountable. Better yet, find a “budgeting buddy” and help hold each other accountable – it could be fun, and it will be financially rewarding!

NEBAT offers a range of resources to help you manage your finances. From kids to teens and adults, we offer support for everyone. Managing financial stress isn’t always easy but taking one step in the right direction will pay dividends!