Business owners often find themselves juggling a multitude of responsibilities, from daily operations to long-term strategic planning. The benefits of a business checking account can be game changing, helping to streamline finances and save valuable time and money. This enables business owners and employees to focus on what truly matters: running and growing the business.

Whether launching a new venture or refining the financial management of an existing business, a dedicated business checking account is essential for managing finances effectively. National Exchange Bank & Trust offers a variety of business banking accounts and services to help business owners optimize their financial management. In this guide, we’ll answer common questions about business banking accounts and highlight the benefits they provide.

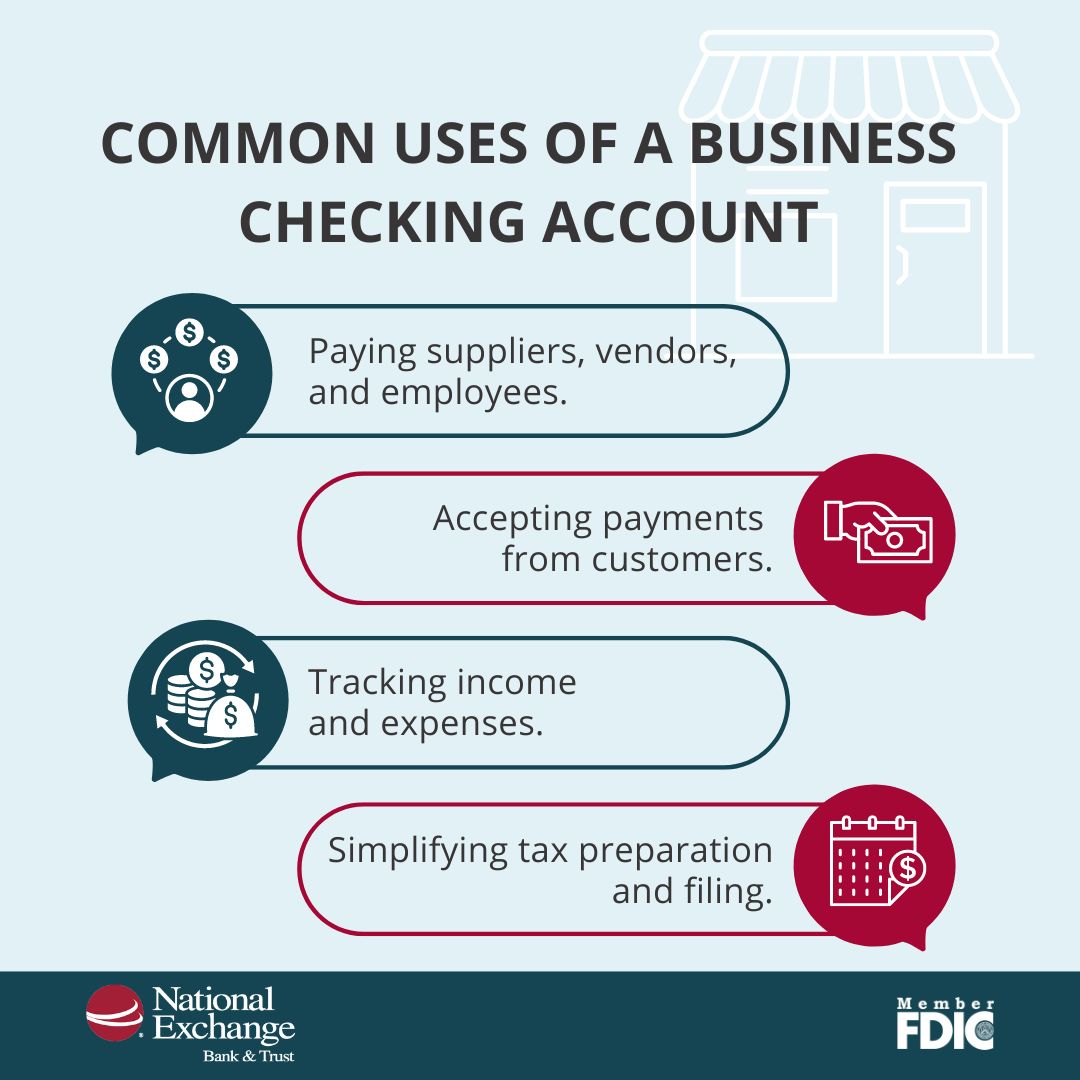

What Is a Business Checking Account Commonly Used For?

A business checking account is a must have tool for managing the transfer of money for a company. It is commonly used for handling daily business transactions such as receiving payments from customers, paying vendors and employees, and covering operational expenses.

What Is Required to Open a Business Checking Account?

To open a business checking account, some personal and business information will need to be provided, as well as some documents which vary based on the type of business entity. Some or all of the following are commonly required and will depend on the legal structure of the business:

- Tax ID number - which can be easily and quickly set up through the IRS.

- Driver’s license or a form of personal identification.

- Organizing documentation such as Articles of Incorporation or LLC governing documents.

- The names of individuals who will be listed as account owners. At National Exchange Bank & Trust, individuals that own more than 25% of the business will need to be disclosed.

- The minimum deposit amount.

What are the Benefits of a Business Checking Account?

A business checking account offers numerous benefits that can significantly enhance the financial management of a company, including:

- Organized records for accounting purposes. Your accountant will thank you when you’re able to quickly provide them with accurate records of your business’s financial interactions. Additionally, this saves you from having to differentiate between personal banking records and business banking records.

- Accurate statements for filing business taxes. Having all of your business statements in a single location will help gathering them for tax time much more efficient. This saves you time in having to decipher what is personal and what is for your business.

- Growth opportunities for your business. Setting up your business for financial growth is what every business owner aims for and having a business bank account helps because it establishes your business’s credibility. Writing checks and using a credit or debit card in your business’s name is much more professional than using your first and last name.

- Straight-forward tracking to avoid overspending. If your personal transactions are mixed in with your business transactions, then it’s extremely difficult to have a true grasp on where your money is being spent. Giving your personal and business purchases their own accounts paints a better picture on where your money is going.

- Segregated financial information for your business. Having a bank account dedicated solely to your business allows that account to include any and all relevant information relating to your business. This avoids confusion for you and the financial experts you’re partnering with.

What Benefits Does National Exchange Bank Provide for Business Checking Accounts?

National Exchange Bank & Trust combines the capabilities of a big bank with the personalized service of a local, independent bank. We offer all the services of a bigger bank while providing a more individualized approach to customer service, something larger institutions often can't match. Our dedicated team works hard to understand the unique needs of each business and recommend the best accounts and services to fit those needs. We also prioritize security, with our fraud support team monitoring transactions and alerting clients of any suspicious transactions. Additionally, we offer add-on fraud mitigation products like Tokenization and ACH Positive Pay, to make sure business accounts are protected as much as possible. During business hours, any of our representatives across our locations can provide assistance via phone, email or live chat.

Alongside providing personalized customer service, our business checking accounts offer a wide range of convenient features designed to efficiently manage business finances, including:

- Secure online access to review accounts.

- Advanced functions such as ACH direct deposits for payroll or paying vendors.

- Ability to offer ACH to clients such as landlords to offer automatic rental payments from tenants.

- Remote deposit capture for scanning and depositing multiple checks remotely.

- A mobile app with mobile deposit.

- Bill pay.

- Money transfers.

- Wire transfers.

- Positive Pay Fraud protection.

- No transaction limits.

- Earnings credit (select accounts only).

In addition to business checking accounts, National Exchange Bank & Trust provides a wide range of business banking services to support business needs, including Business eBanking, which allows you to take full advantage of your business bank accounts. Some of the benefits include:

- Powerful reporting features to view detailed data. Not only are you able to view your account’s activity with eBanking, but you’re also able to see data dating back months, reference images of your checks, and export the data in various file formats.

- Premium alerts to keep your money and information safe. Our early identification system sends you alerts regarding attempted fraud, and you can customize these alerts based on what your business needs. Whether they’re for account activity, balance levels, or approval statuses, your alerts can be sent to you via email, text message, or both.

- Easy and efficient movement of your money. Our instant account-to-account transfers make it easy to pay bills or employees. You also have the ability to schedule recurring transactions to eliminate the time you spend paying others.

Unlike large banks with millions of customers, our local, independent culture allows us to tailor solutions to you and your business. We encourage you to get in touch so that a member of our team can work with you to transition or create your business bank account with National Exchange Bank & Trust.