Tax Season Reminder

Paper checks are no longer being issued for tax refunds. Learn what steps to take to ensure your refund arrives quickly and securely in our recent blog.

It’s a familiar story for many small business owners: You spot an opportunity to grow your business - maybe it’s launching a new product line for the holidays or scaling up operations to meet seasonal demand, but you need capital to make it happen. While summer is still in full swing, many business owners are already looking ahead to the busy holiday season, and some are celebrating Christmas in July with their busy season happening right now! Whether you need to stock up on inventory, hire seasonal staff, or boost marketing efforts, planning for your business’s busy season and having access to extra capital can be a powerful way to support and accelerate business growth.

That’s where a Business Line of Credit comes in, also known as a Working Capital Line of Credit. With a business line of credit in place, that opportunity becomes possible. Unlike a traditional loan, a business line of credit allows you to access funds as needed, giving you the ability to act quickly and invest in growth strategies without overextending your cash flow. Let’s explore how it works, how it compares to other financing options, and why it’s such a smart move for businesses heading into their busy “holiday” season – whenever that may be.

A business line of credit gives you access to a set amount of funds that you can draw from as needed, similar to a credit card, but with lower interest rates and higher limits.

You only pay interest on the amount you use, and once you repay it, the funds become available again. This makes it ideal for managing seasonal expenses, cash flow gaps, or investing in short-term growth.

Here’s a quick comparison:

| Feature | Business Line of Credit | Business Loan |

|---|---|---|

| Flexibility | Draw as needed | Lump sum upfront |

| Interest | Pay only on what you use | Interest on total amount |

| Repayment Terms | Revolving (reusable) | Fixed schedule |

| Best For | Ongoing or unpredictable expenses | One-time large purchases |

So if you're deciding between a business line of credit vs. a business loan, consider this: loans are great for larger expenses such as buying equipment or opening a new location. However, if you’re prepping for the holidays with rolling expenses, a business line of credit gives you the breathing room to scale without overcommitting.

Absolutely. Most lenders offer lines of credit to LLCs, corporations, and even sole proprietors. The approval typically depends on:

If you're an LLC preparing for the holiday season, now is the time to apply, before you need it. Having a line of credit in place gives you the freedom to act quickly when opportunities arise.

Start a Loan Inquiry Find Your Local Lender

It starts with smart, timely financing. If you’re preparing to:

…then a business line of credit can give you the flexibility to act fast and scale strategically. You borrow only what you need, when you need it, so you can make the most of the holiday season without straining your cash flow.

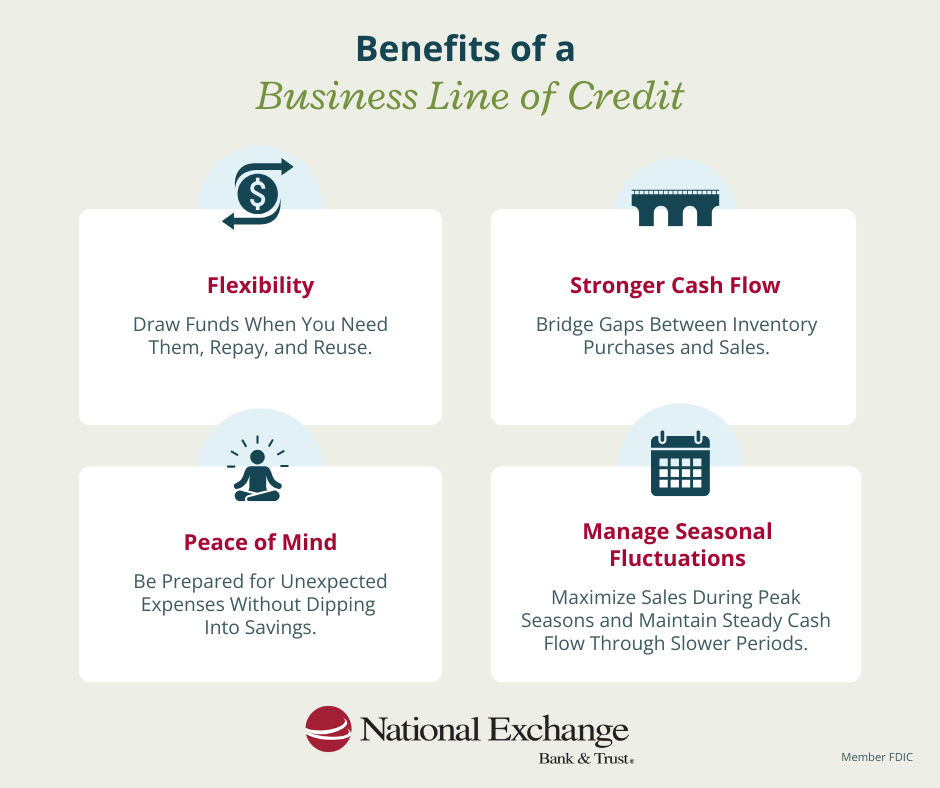

Let’s sum up the key reasons more small business owners are leaning into credit lines to prep for busy seasons and long-term growth:

Contact your local lender at National Exchange Bank & Trust to see how a business line of credit can fit into your holiday growth strategy. Let’s plan for your busiest season together.