Your mortgage journey has begun, congratulations! You know you need a loan to buy a home, but you could be overwhelmed at where to start. With the various mortgage lender and broker options out there, it’s important to understand what the true difference is between a mortgage lender vs. a broker.

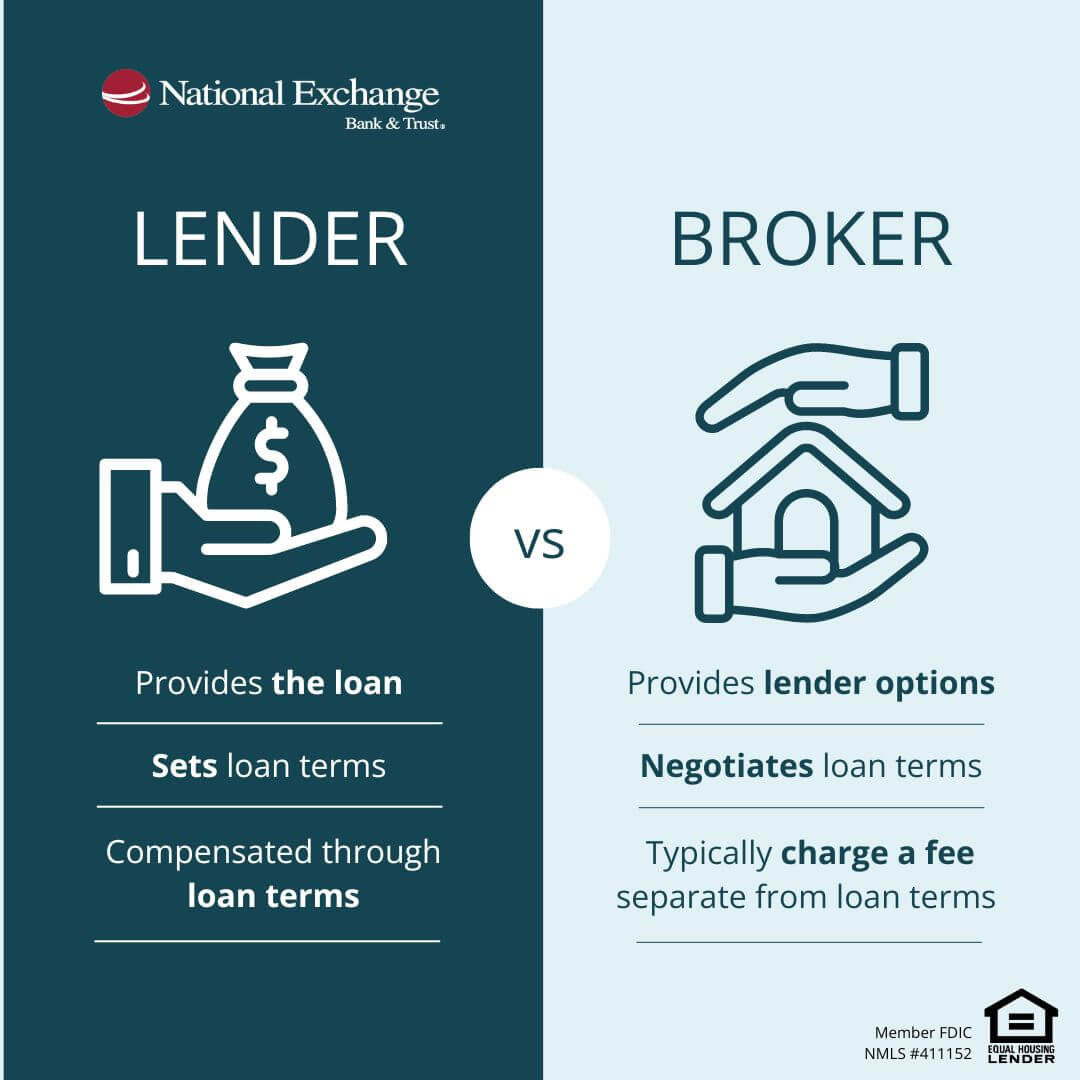

The key difference lies in who provides the money: A mortgage lender is the party responsible for providing the funds, while a broker acts as a matchmaker, connecting you with a lender. But which option is right for you? Dive deeper in this blog as we explore the roles of mortgage lenders and brokers, helping you navigate this important financial decision.

What is a Mortgage Lender?

NEBAT is defined as a mortgage lender. In other words, a financial institution that you directly get the funds from. NEBAT offers both conventional and in-house mortgages where we set the terms of the loan, including the interest rate, repayment schedule, and down payment requirements. We’ll also work alongside you to assess your financial situation, including your credit score, income, and employment history, to determine your eligibility and loan amount.

At NEBAT, you’re paired with a local mortgage lender who works with you to provide a preferred pre-approval letter. Then, we’ll work together consistently throughout the purchase process to get all the information needed for your mortgage. This includes helping you navigate documentation, answering any questions, and communicating with any parties involved. Consider us your mortgage quarterback!

A few other things that happen in the background include:

- Offering financial education throughout the process by providing you with additional information any time you need it.

- Analyzing your financial documents to determine your ability to repay the loan.

- Setting loan terms. This includes the interest rate, loan amount, and repayment period.

- Funding your loan. Once you've been approved, we’ll provide the money to purchase your home.

It is also important to note that NEBAT services your loan; this means we handle your monthly payments and escrow accounts (if applicable), and you can pay at any office or online. Additionally, we are here to answer any questions you might have throughout the term of the loan. Building a relationship with our customers for 30+ years is what we are all about!

Each mortgage lender may have different loan programs, interest rates, and eligibility requirements. NEBAT works closely with you, so you understand exactly what we are providing, thus helping you make an informed decision.

What is a Mortgage Broker?

A mortgage broker isn't a lender themselves, but rather an individual who matches you with a lender who fits your needs. Brokers work with a network of lenders and then match you to the one they feel would be a good fit.

Here's how a mortgage broker assists their clients:

- Compare loan options. They'll assess your needs and match you with lenders offering programs that align with your credit score, down payment, and desired loan amount.

- Negotiates rates and terms. Brokers can leverage their relationships to define rates and terms with the lenders they work with.

- Offers guidance and expertise. Some brokers will educate you on different loan options and answer any questions you may have throughout the process.

It's important to note that mortgage brokers typically charge a fee for their services, often a percentage of the loan amount. Depending on the broker, this fee can be paid by you or by the lender at closing.

Now that you’ve learned the key differences between a mortgage lender vs. a mortgage broker, it’s time to decide on what the best fit will be. Make a list of options, ask family and friends for recommendations, and do your research to help you decide.

At NEBAT, you reap the benefits of knowing you’re working with a local organization that offers competitive terms and rates and with local lenders who are always just a phone call or an email away. We encourage you to reach out to your local office; we are happy to help!!