Tax Season Reminder

Paper checks are no longer being issued for tax refunds. Learn what steps to take to ensure your refund arrives quickly and securely in our recent blog.

Social media is a blessing and a curse. We love scrolling our newsfeed to see our friend’s newest engagement photos, pics of our sweet nieces and nephews, and let’s not forget the funny videos we stumble upon. Then there are posts that catch our attention in a different way… we’ve all seen it. You’re scrolling through social media and see a friend post “Just for fun, answer this Q&A” or “Ask your spouse these 10 questions and post their answers.” Sometimes it's “Copy and paste this private message and send it to 5 friends.”

Believe it or not, it’s these posts that lead users down the path of giving away personal information in sneaky social media scams.

Think about the passwords you have. Now, think about the Q&A social media posts you see with questions like “What is your pet’s name?” or “When is your anniversary?”

These questions often line up with passwords, password hints, or the verification questions many websites offer to help stay secure. Scammers will snatch this information right up.

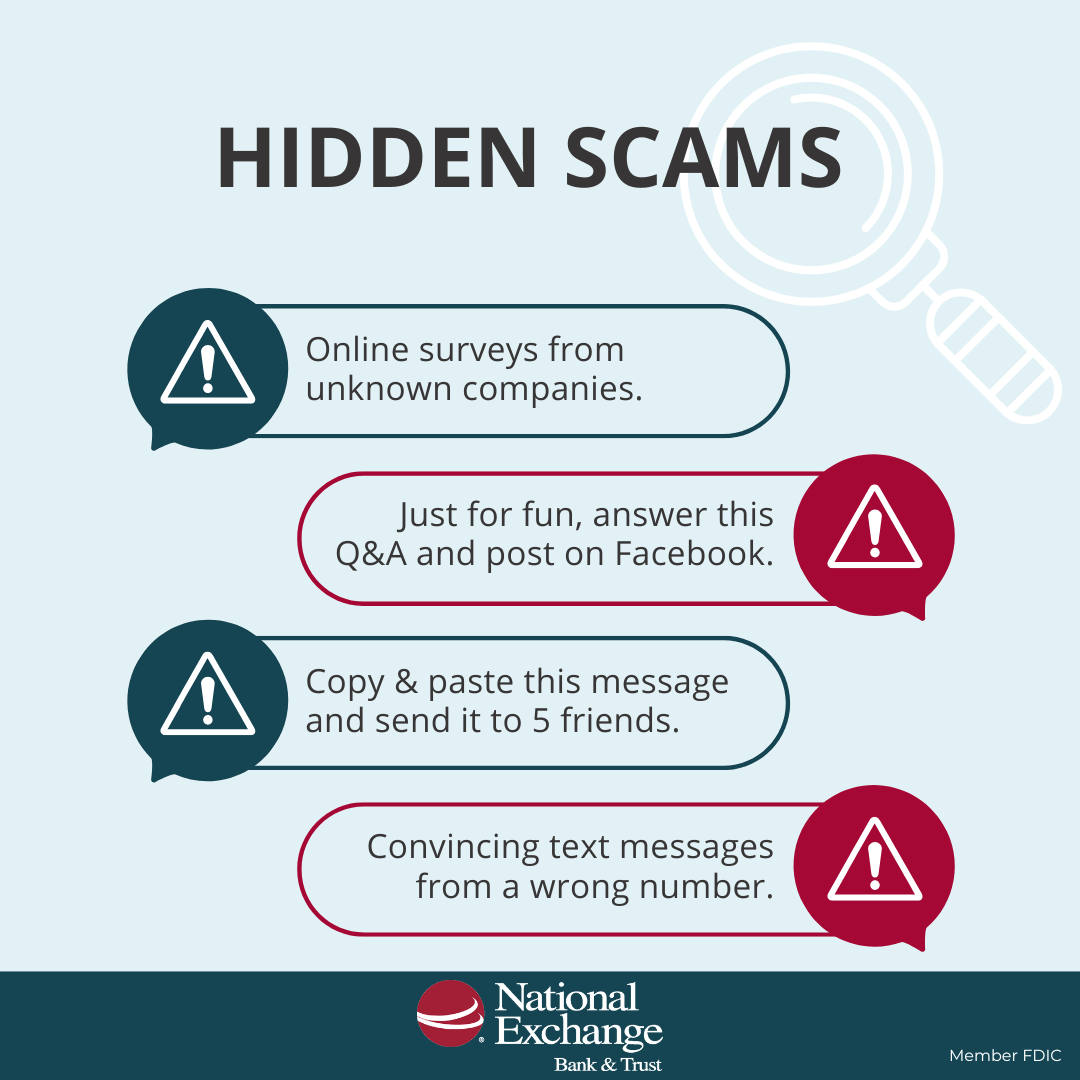

Social media scams cover just some of the hidden scams out there. Scammers will find any way they can to take your information.

Here are a few additional scams to be aware of that may seem less obvious:

We don’t mean to scare you! We simply share this information to help you be aware of all the sneaky ways scammers will use to gain personal information. Now that you know what to be on the lookout for, here are a few additional tips to protect your personal information online and keep your information private:

As always National Exchange Bank & Trust is here to help you protect your personal information. Check out our Fraud Resource Center for ongoing scams and other resources.

Common personal information targets include Social Security numbers, credit card or bank account details, login credentials, and birthdates.

In general, be cautious of unsolicited messages, verify profiles before engaging, and never share personal or financial information. Set your privacy settings to restrict who can see your posts and personal details.

Change your passwords immediately, avoid all communication with the scammer, report the scam to the platform, and monitor your accounts for suspicious activity. See our fraud resources page for additional steps to take and more information.