You’ve decided to open your own business, congratulations! Whether you’re in the first steps of navigating where to start or have already begun the initial stages, this article is full of tips, advice, and takeaways to help you along your journey. Remember, NEBAT’s local business lenders are always a phone call away if you need more support or have questions.

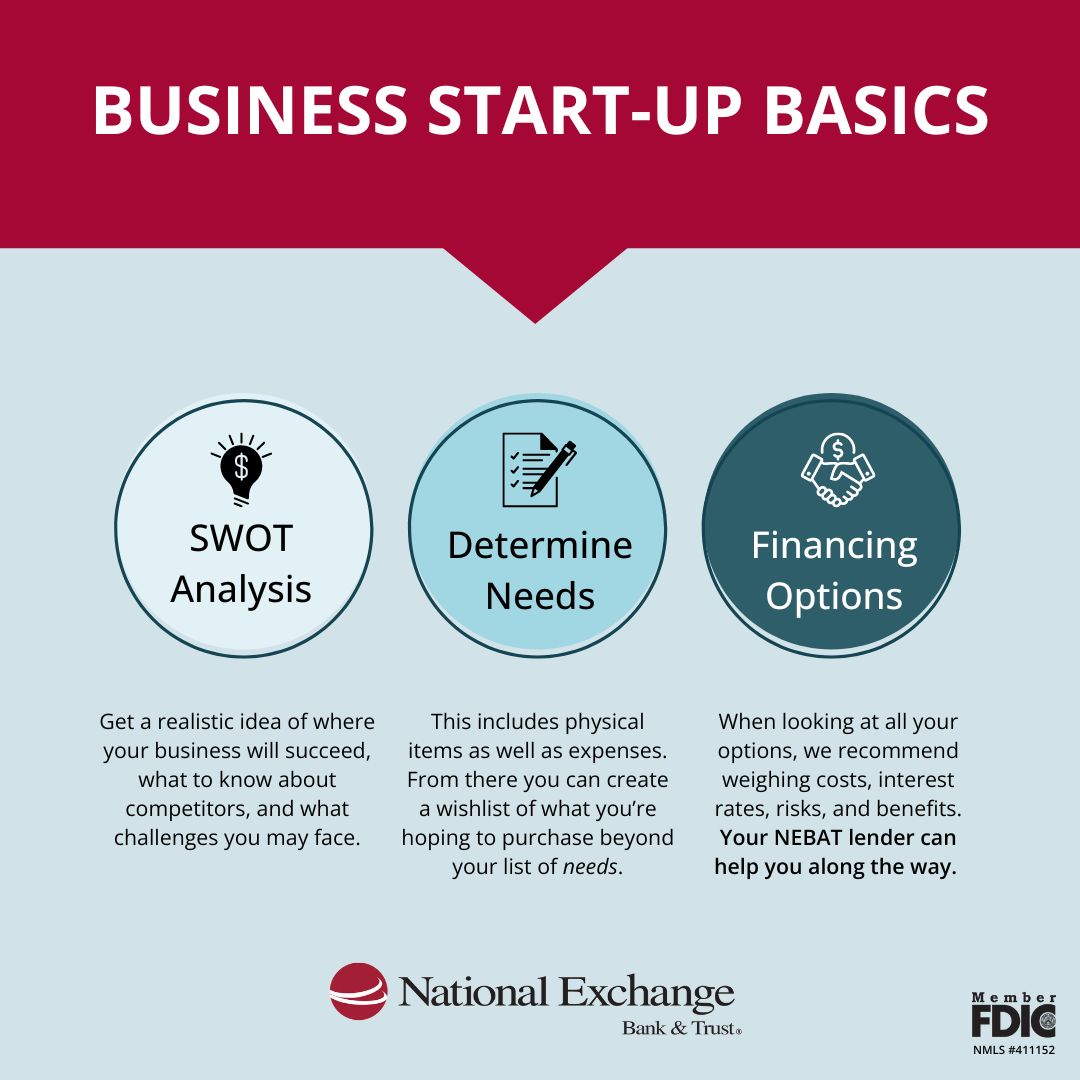

Business Start-Up Basics

- Start with a SWOT Analysis

- Determine Your Needs & Wants

- Write a Business Plan

- Outline Financing Options

- Make it Happen

Start with a SWOT Analysis

Strengths:

- What will set it apart from the competition?

- What benefits does your product or service offer? (E.g., quality, skilled labor, or low-cost production)

- What other advantages does your business have? (E.g., Convenient location, technology, or partnerships)

Weaknesses:

- What do your competitors do well?

- What limitations do you have? (E.g., technology, brick & mortar location, resources)

- What will your company lack that the competitors offer?

Opportunities:

- In what areas do you see your company growing-in over time? (E.g., new products or services, additional locations)

- Is there a product or service not yet offered by the competition or not offered in your area?

- What are new ways to market your company compared to competition?

Threats:

- What do you predict may change with the competition?

- How could the economy impact your business?

- In what ways could customers have a negative impression of your company?

- How will supply, demand and the supply chain impact your business?

Determine Your Needs & Wants

The next step in our business start-up guide is to create a list of everything you’ll need to have to run your business. This includes physical items as well as expenses. Remember to reference your SWOT analysis during this process as well. Below are a few examples:

- Employees - including salary and benefits.

- Technology - from laptops to point-of-sale systems.

- Equipment - machinery, storage, or displays.

- Brick & Mortar Location - renovations needed, rent, insurance, etc.

- Marketing & Advertising – signage, branding, sales materials, etc.

- Insurance.

From there you can create a wish list of what you’re hoping to purchase beyond your list of needs. A few examples could be:

- Advanced Technology

- Decor for Your Business

- An Additional Storage Facility for Inventory

- Employee Incentive Programs

Write a Business Plan

With the information you’ve outlined above you can put pencil to paper, do the research and put in writing how your business will operate including revenue, expenses, and profits. You will want your business plan to include financial projections for three years (balance sheet and income statements). The U.S. Small Business Administration has resources to help you write your business plan:

Outline Financing Options

We’ve all heard the saying “It takes money, to make money;” at this point in your start-up it’s time to weigh your financing options. This can range from how much you’ll personally invest, to seeking an outside investor, fundraising, or requesting a bank loan. If a business loan is something you want to learn more about, have your business plan in hand along with documentation on your personal net worth (tax returns for the previous two years and personal financial templates) then reach out to a NEBAT lender. During this process, they will want to get to know your business on a deeper level. This will allow them to help you determine a loan option that would fit your needs or develop a custom solution.

When looking at all your options, we recommend weighing costs, interest rates, risks, and benefits. A simple pro & con list could do the trick. It’s important to be well-educated on all financing options before you come to your final decision. Your NEBAT lender can help you along the way.

Making it Happen

Once your SWOT analysis is complete and your financing is secured, it’s time to really get to work. You can now purchase assets, move into your store front, begin hiring employees, market your business, and eventually serve your customers.

As you continue on your journey, remember to learn and grow within your industry. NEBAT lenders are always available to meet with you to provide business advice, offer referrals, and guide you along the way.