Construction is projected to boom in 2026. AI-driven data centers, infrastructure, housing and commercial construction projects are all on the rise. Securing a Business Construction Loan is an essential early step for businesses evaluating commercial construction financing options in today’s growing market.

Business Construction Loans are highly specialized. Each loan is structured around the unique needs of the business and its construction plan. It’s crucial for business owners to choose a lender that has deep local roots and the expertise to navigate the complexities involved. As a trusted Wisconsin-based business lender for more than 90 years, National Exchange Bank & Trust can guide you through the entire Business Construction Loan process and set your business up for success. Contact us today to get started.

What Is a Business Construction Loan?

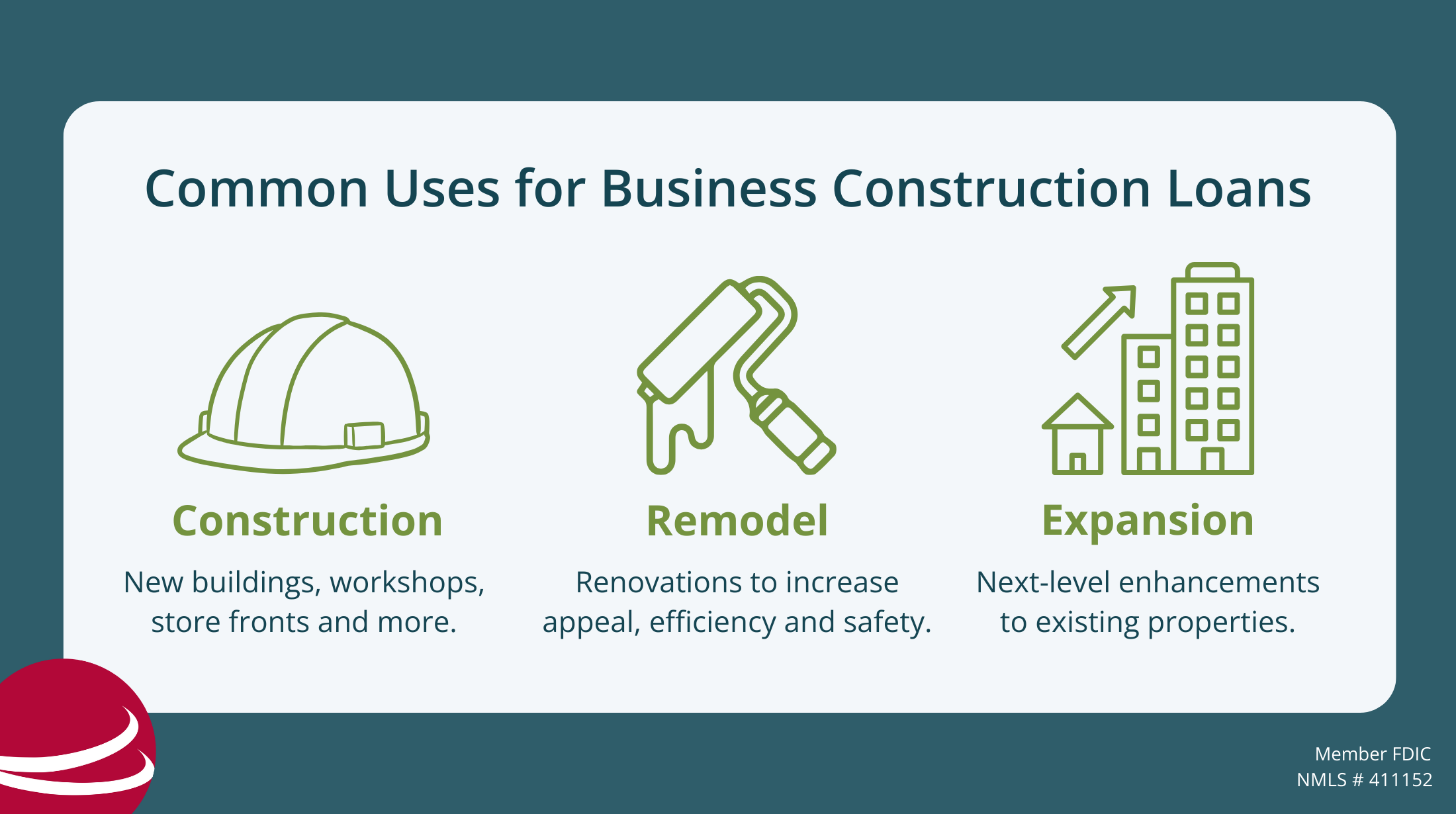

Business Construction Loans cover three main development areas:

- Construction: New buildings, workshops, store fronts and more.

- Remodel: Renovations to increase appeal, efficiency and safety.

- Expansion: Next-level enhancements to existing properties.

A Business Construction Loan is a short-term loan for a business to finance the construction costs of a project. Your lender will issue a Construction Draw Note up to a certain dollar amount based on information you have worked through with your contractor. The terms, interest reserves and fees of a commercial construction loan can vary greatly depending on the project. In general, Business Construction Loans are designed for a 12 - 18 month term with a floating or fixed rate and advances up to 75% of the project's cost.

Learn More about Business Construction Loans Get Started

How Do Business Construction Loans Work?

Once you are issued a Construction Draw Note, draws are coordinated via title company to pay project participants. While your contractor is working on your building or remodeling project, they submit work done to the title company; the title company reviews it and provides a report for the bank.

After construction, your Construction Draw Note will be transferred to a term bank note, determined by your unique business situation. All commercial loans are different, and a Business Construction Loan has a lot of layers to it that elevate the relationship between banker and customer. It’s important to partner with an established bank that can demonstrate extensive local experience and insights.

How Do I Qualify for a Business Construction Loan?

Applying for a Business Construction Loan is a multi-step process that can take anywhere from 60 to 90 days or more. We strongly recommend starting this process early, so you can secure financing before you need it.

1. Gather documentation.

- Project information: Blueprints, material lists, projected costs, permits, construction team, insurance and timeline.

- Financial information: Tax returns, financial statements, business and personal credit history, cash flow projections and proof your business can pay a 10 - 25% down payment.

- Site information: Property appraisal, environmental assessments, zoning approvals, permits and a title report.

- Background information: History of similar construction projects (if any).

2. Find a lender.

- Look for a qualified bank with a proven history of financing Business Construction Loans such as National Exchange Bank & Trust.

3. Apply for a Business Construction Loan.

- Pre-qualification: Discuss project scope, financial standing and potential loan structure with your local lender.

- Formal application: Complete the lender’s application, including submission of documentation gathered in step one.

- Lender review and underwriting: Allow time for the lender to review your application and assess your project’s viability, risk factors and future value.

4. Loan approval and closing

- Approval: Receive a commitment letter from your lender, detailing Business Construction Loan terms, conditions, draw schedule and interest rates.

- Closing: Sign loan documents and pay closing costs. Now it’s time to build!

Set Your Business up for Success with a Qualified Business Construction Lender

Discover how the right business construction lender can build a framework for success. As a bank with decades of Business Construction Loan expertise, NEBAT works hand-in-hand with business owners to provide a solid foundation for construction projects.

Ready to start your construction project? Contact your local National Exchange Bank & Trust office to start working on your Business Construction Loan.

Contact Your Local Office Find Your Local Business Lender

FAQS

Which Industries Benefit from Business Construction Loans?

Any industry that operates in a physical facility can benefit from a Business Construction Loan. National Exchange Bank & Trust partners with all kinds of businesses to help them succeed. We have knowledgeable lenders with years of experience in a variety of different industries, all of which can utilize Business Construction Loans to realize concrete growth objectives. We serve several key industries which earn the greatest benefits from Business Construction Loans:

- Manufacturers can grow production capacity, upgrade facilities with new technology and add vertical integration capabilities.

- Industrial parks can develop unused land or underutilized areas, upgrade outdated infrastructure and improve sustainability.

- Retailers can design custom storefronts tailored to your brand, expand into new markets and refresh aging exteriors to remain attractive.

- Municipalities can renovate old infrastructure to meet current safety and accessibility codes, expand to serve more communities and design workflow-optimized spaces that boost efficiency.

- Healthcare providers can increase patient capacity, invest in specialized treatment centers and meet the growing demand of an aging population.

Are there Alternatives to Construction Loans?

If you aren’t sure that a Business Construction Loan will fully meet your needs, there are a few different types of loans you may consider.

Business Equipment Loans provide lump-sum funds to purchase construction tools like machinery, vehicles or technology. The equipment you purchase serves as collateral. You repay the loan through monthly installments on a fixed timeline, often 2-7 years depending on the specific equipment.

Best suited for: Businesses that require high-cost, specialized equipment.

A Working Capital Line of Credit is a revolving line designed to fund the expansion and contraction of the balance sheet. Working Capital Lines of Credit are ideal for managing accounts receivables, inventories, payables and short-term cash needs

Best suited for: Businesses with cash flow gaps, high volumes of inventory, or irregular payment schedules.

Specialty Loans offer tailored financing solutions for unique business needs that don’t fit standard loan categories. They can support projects such as equipment purchases, real estate investments, acquisitions and other specialized opportunities. Terms, rates and repayment schedules are tailored to your specific needs.

Best suited for: Businesses or individuals pursuing specialized projects or investments that require customized financing solutions.