Every homeownership journey starts with a dream—maybe it's a cozy backyard for your kids to play in, a quiet office for your side hustle, or simply the security of a place to call your own. But for many people across Wisconsin, that dream gets stalled by one big hurdle: the down payment.

As a local, community bank, National Exchange Bank & Trust is committed to helping individuals and families establish financial stability and grow roots in our communities. That is why we’re excited to shed light on the Downpayment Plus Program (DPP), a valuable resource for Wisconsin homebuyers. The grant program offered by the Federal Home Loan Bank of Chicago (FHLBank Chicago) is designed to support housing affordability and help turn the dream of homeownership into a reality.

Who Can Qualify for the Downpayment Plus Program?

DPP extends beyond just first-time buyers—it’s designed for any qualified homebuyer who meets the income criteria. Eligible buyers earning up to 80% of the area median income can receive assistance, up to $10,000 or 25% of the first mortgage amount, for the down payment of a home, according to FHLBank Chicago. Whether you're upgrading, downsizing, or buying your first home, the program is instrumental in making homeownership accessible for Wisconsin residents.

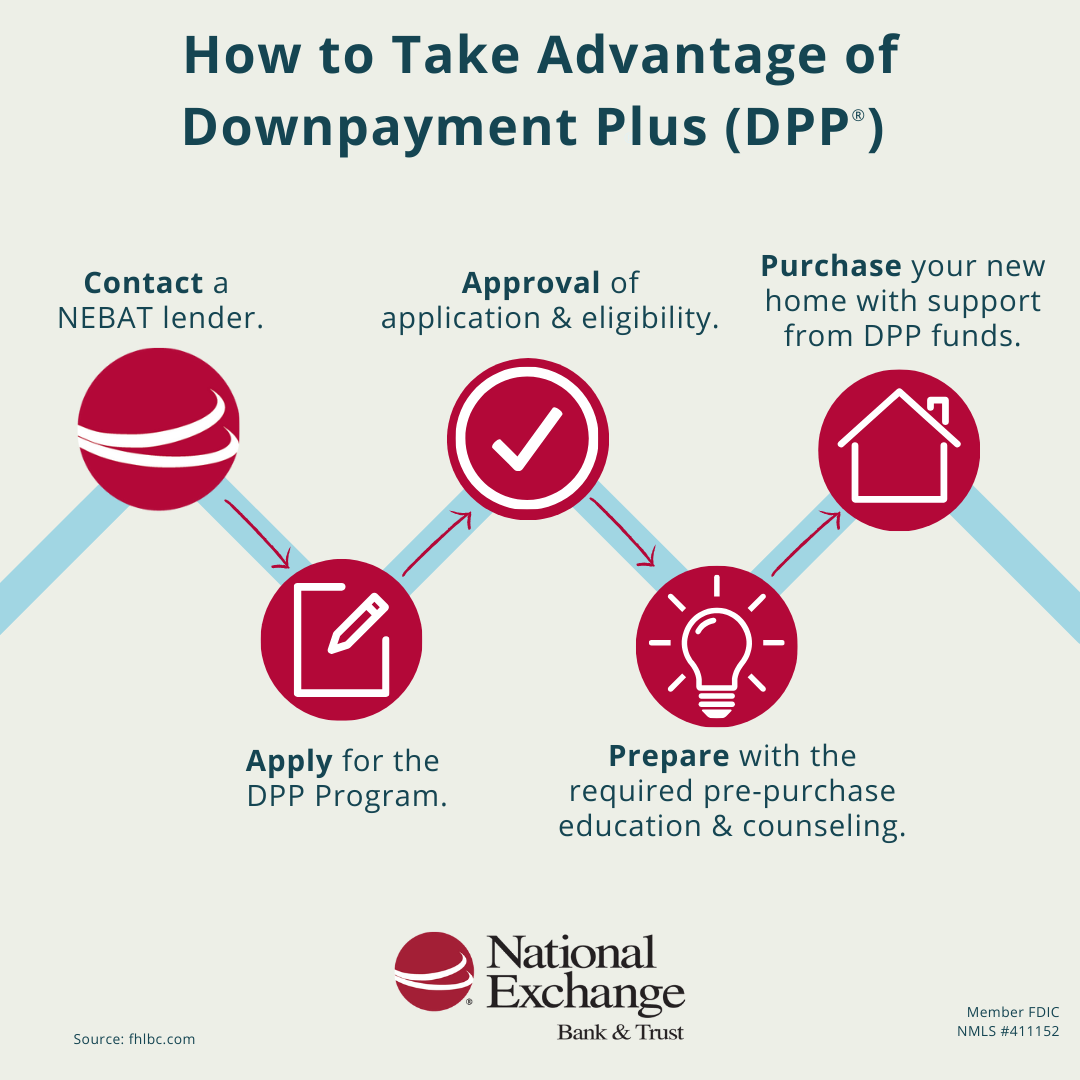

How the Downpayment Plus Program Works

The Downpayment Plus Program is designed to break down the financial barriers of purchasing a home.

A Commitment to Affordability:

In 2025, the FHLBank Chicago set aside $46 million to support homebuyers by providing down payment assistance. This investment aims to make homeownership more accessible for individuals and families facing affordability challenges.

How Wisconsin Home Buyers Can Benefit:

The program provides eligible homebuyers with a forgivable grant—meaning you won’t have to repay the assistance as long as the home remains your primary residence. The grant is applied at closing when financing through a participating member financial institution like National Exchange Bank & Trust.

After securing your mortgage at National Exchange Bank & Trust, your local lender will guide you through the application process for the Downpayment Plus program.

How the DPP Program Opens More Doors for Buyers

With low housing inventory across Wisconsin and nationwide, today’s homebuyers are navigating a highly competitive market where demand is driving up home prices. Mark Witt (NMLS #: 469702), AVP/Retail Lending Supervisor at National Exchange Bank & Trust, has seen firsthand how this supply shortage, combined with rising rental costs, makes it especially difficult for first-time homebuyers to reach their homeownership goals.

That’s why the DPP program is a valuable resource. It provides qualified buyers with grant funds that can be used not only for down payments but also to help with closing costs, making homeownership more attainable. According to Mark, these funds can help buyers qualify for homes they might not otherwise be able to afford, reduce the overall loan amount and interest paid overtime, and allow them to keep more money in the bank for future home upgrades.

Mark says that “With free online education, a minimal counseling fee, and a high approval rate, the program is a great tool to help Wisconsin homebuyers compete in today’s tight housing market.”

National Exchange Bank & Trust’s seasoned lenders are experienced with the DPP program to help streamline the process for buyers, helping to ensure closing dates stay on track. Our lenders pride themselves on building lasting relationships and are here to provide expert guidance before, during, and after the homebuying journey is complete.

If you’re thinking about buying a home in 2025, don’t let the down payment hold you back. With the Downpayment Plus Grant Program, the support you need may already be within reach.

Contact your local lender at National Exchange Bank & Trust today to start the conversation.