Personal Mobile & eBanking Access Issues

We’re aware of an issue affecting access to Exchange OnLine and Personal Mobile Banking for some customers. Our team is working to restore full service as quickly as possible. We appreciate your patience.

April is Financial Literacy Month, a time to highlight the importance of financial education. It’s a great time to reflect on how you have been helping the kids in your life develop money management skills or create a plan to help start their financial education journey. Imagine a world where every child grows up with the skills to manage their finances responsibly, making informed financial choices as they navigate life’s challenges. This month offers a special opportunity to reflect on how we can make that vision a reality!

Explore the benefits of financial literacy, get helpful tips for introducing money concepts to your kids, and find out how National Exchange Bank & Trust can be a partner in setting them on the path to financial success through our Youth Financial Programs. Let’s help them build a strong foundation for their future!

Teaching kids how to manage money isn’t just about handing them cash or setting up a savings account—it’s about giving them the tools they’ll carry with them for the rest of their lives. Imagine a child deciding how to spend their allowance, carefully planning for a big purchase, or even managing debt when they’re older.

Take, for example, the moment when a child learns the difference between needs and wants. Suddenly, they’re not rushing to buy every toy or gadget they see. Instead, they begin to make thoughtful choices and avoid impulsive ones. When they grasp the importance of budgeting and saving, they start to see the bigger picture—learning how to plan ahead, make responsible decisions, and take control of their financial future.

The advantages of financial literacy for kids are far-reaching. The earlier kids are exposed to financial education, the more likely they are to manage their finances responsibly in adulthood. Learn how to help them build a bright financial future with National Exchange Bank & Trusts’ Steps Youth Financial Programs.

Steps Youth Financial Programs

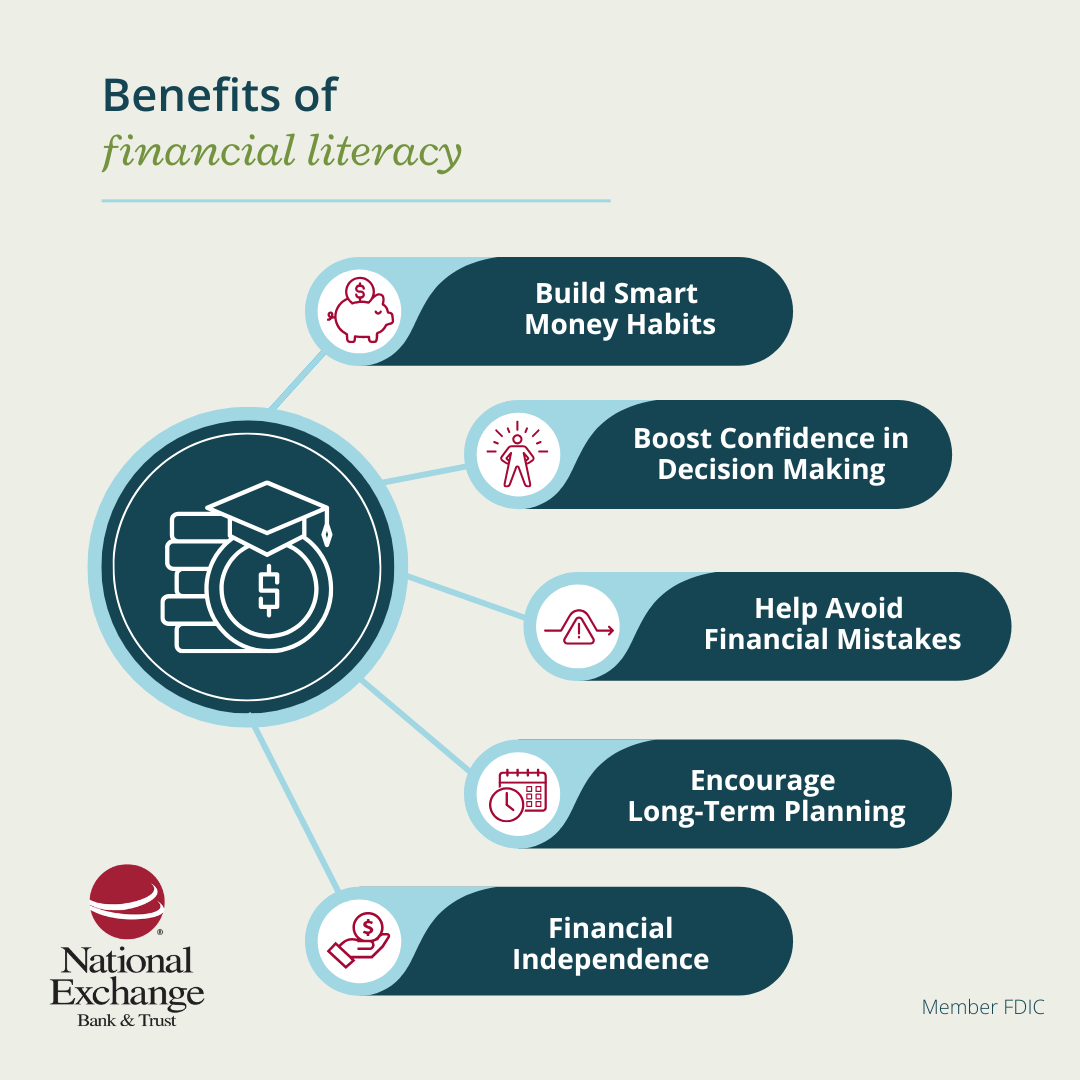

Financial literacy for kids is important as it helps build the tools and resources one needs to understand the concepts of money management. At a basic level for kids this can include how to earn, save and spend, wisely. Advantages of teaching financial literacy to kids starting from a young age include:

There are many ways to introduce kids to the concept of financial literacy. Start small by teaching them how to save in a savings account, and gradually increase the complexity of their financial education. Here are some strategies to get started:

There are plenty of age-appropriate lessons and activities out there to help you get started without having to recreate the wheel. A great example is our financial education resource pages, including our pages for children, teens and young adults.