Streamline Business Transactions

At National Exchange Bank & Trust, we understand that managing business finances can feel like a never-ending balancing act. Every payment, invoice, and transaction are steps toward keeping your business running smoothly. That’s why many businesses are choosing to enable the ACH service for businesses, an efficient, cost-effective way to handle transactions. Whether you’re paying vendors, collecting rent, or managing payroll, ACH can simplify your financial processes.

In this guide, we’ll explore how the ACH service works for businesses, why ACH funds transfers are becoming the go-to payment method, and how you can set them up for business-to-business (B2B) transactions and more. By the end, you’ll have a clear understanding of how ACH can provide more control over payments and benefit your business operations.

What Are ACH Funds Transfers Business to Business ACH: A Smarter Way to Pay ACH Funds Transfer vs Wire Transfer Is ACH Right for Your Business?

What Are ACH Funds Transfers and How Do They Work for Businesses?

When you’re running a business, you need a payment and collection method that’s reliable, secure, and cost-effective. ACH (Automated Clearing House) funds transfers provide just that. This system processes payments and collections between banks electronically, allowing businesses to move money securely and quickly without the hassle of paper checks or the fees of wire transfers.

Imagine this: You’ve just sent a payment to a vendor. Instead of writing a check or calling the bank to send a wire, you initiate the payment through National Exchange Bank & Trust’s Business eBanking platform. In a few simple steps, the funds are transferred directly from your business account to your vendor’s account, often within one to three business days.

Business to Business ACH: A Smarter Way to Pay

More businesses are shifting to ACH because it’s a more reliable and affordable solution compared to traditional methods.

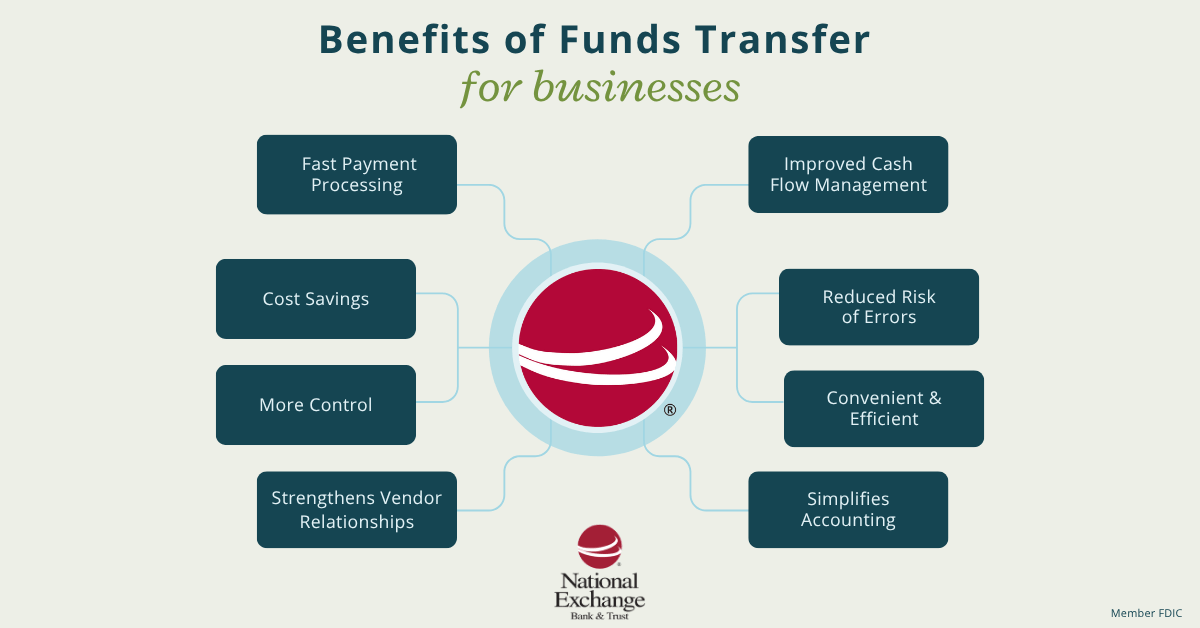

Eliminating the need for paper checks means you no longer have to order checks, pay for postage, or wait for checks to clear, simplifying your accounting and saving both time and money. With ACH, businesses can settle invoices quickly, reduce the risk of errors, and enjoy faster, more secure transactions that both businesses and vendors can rely on. This leads to significant savings, simplified management of day-to-day expenses, and stronger vendor relationships.

ACH Funds Transfer vs Wire Transfer: Which Is Better for Your Business?

Both ACH and wire transfers are secure ways to move money, but when it comes to cost and efficiency, ACH often wins. On average, here’s how they compare:

| Feature | ACH Funds Transfer | Wire Transfer |

|---|---|---|

| Cost | $25/month and $0.25 per transaction* | Domestic Outgoing $25; Domestic Incoming $15* |

| Speed | 1-3 business days** | Same-day (usually) |

| Use Case | Recurring, bulk, and domestic payments | One-time, high value, or urgent payments |

| Fraud | Scams are not as common | Frequent target of scams |

| Reversibility | Sometimes reversible | Generally irreversible |

Is ACH Right for Your Business?

ACH Funds Transfer for business can transform the way financial transactions are handled. Whether paying vendors, managing payroll, or collecting rent, ACH is a smart, secure, and affordable solution that can save time and money.

With lower fees than wire transfer, improved efficiency, and the ability to automate payments, utilizing ACH funds transfer pays off in the long run. Take control of your business’s financial future today!

Learn more about National Exchange Bank & Trust’s online cash management solutions and contact our Business Services Group to learn how Business ACH payment and collection options can work for your unique needs.

Contact Us ACH Educational Videos Business Online Banking Solutions

FAQ’s

What is a B2B ACH funds transfer?

ACH stands for Automated Clearing House; an ACH funds transfer is an electronic payment or collection made through the ACH network. Transactions made directly to or from your checking account are made via the ACH network, such as your paycheck for Direct Deposit or when you auto pay your energy bill with your checking account.

Is ACH safer than wire transfer?

ACH funds transfers are generally safer than wire transfers because they are subject to federal regulations, offer a grace period for reversing transactions, and are managed by NACHA, which oversees the ACH network and protects customers. Wire transfers, while secure, are immediate and typically can’t be reversed in case of error or fraud.

Do tenants need a bank account for ACH rent payments?

Yes, tenants typically need a bank account to make ACH rent payments. Since ACH transfers involve authorizing the landlord to withdraw funds directly, tenants must provide their bank’s routing and account numbers.