*ding* Your phone buzzes and you look at the notification. It’s a text from your family member asking if you sent a check their way for the $400 you owe them. You message them back telling them you sent it and saw that the money was withdrawn from your account already. They respond letting you know they never received it and your heart sinks. Budgeting that money the first time was not easy… how are you going to come up with another $400? As your heart sinks further, you realize you must have fallen victim to check washing.

Check fraud refers to various criminal acts that involve making unlawful changes to or uses of checks to illegally acquire funds. Although other payment methods are becoming more popular, checks are still common, so it is important to understand how check fraud works.

How Do Scammers Do It?

There are a few common ways in which scammers can commit check fraud:

Forgery. This includes altering details on a genuine check or forging the entire check altogether to steal money.

Counterfeit Checks. Fraudsters create fake checks that mimic genuine ones.

Check Washing. This is when criminals steal mail and use chemicals to erase the name of the payee on the check to deposit the money into another, fraudulent account.

Overpayment. Overpayment scams occur when the fraudster sends a check for more than the item being sold is worth. They ask the difference to be wired back to them. In the end, the check bounces and the fraudster has gotten away with the item plus some money.

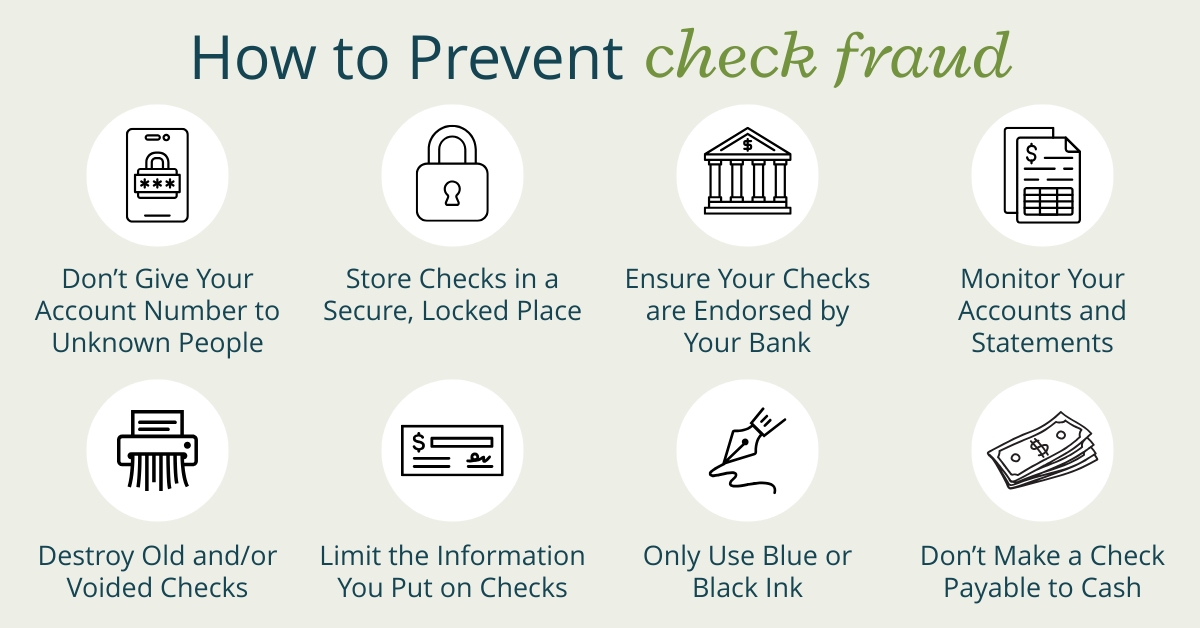

Preventing Check Fraud

Here are a variety of general check fraud prevention steps that you can and should follow to maintain a healthy and successful financial status:

- Never give your account number to people you don’t know. Your account number is a gateway to your personal information, and if in the wrong hands, could lead to theft.

- Store your checks in a secure and locked location. Like anything else that is valuable in your home or personal space, checks should always be stored in a safe and secure location.

- Make sure your checks are endorsed by your financial institution. Endorsed checks are easier to track and are flagged by your bank when there is any kind of activity, making it quicker for you to identify fraud.

- Monitor your accounts and review your bank statements each month to detect suspicious activity. Closely monitoring your accounts with online and mobile banking helps detect fraud in a timely manner. Looking at your monthly statements gives you a reminder of where your financial situation stands.

- Unless needed for tax purposes, destroy any old or voided checks. With how easy it is to forget about old checks, we recommend using a paper shredder to destroy them as soon as they are no longer needed.

- Don’t write your credit card number on a check. As mentioned above, giving out your account information makes you more susceptible to fraud, and exposing credit card numbers can do the same.

- Consider the type of pen you use to write checks. Studies have shown that most ballpoint or marker inks can be washed from a check, whereas blue or black gel ink gets trapped in paper and is more difficult to wash away.

- Don’t make a check payable to cash. If the check gets lost or stolen, it can then be cashed by anyone.

- Don’t mail bills from your mailbox at night. Night time is when criminal activity is most common and, without help from the sunlight, these criminals can remain anonymous.

- Limit the amount of personal information that’s listed on your checks. Personal information on a check can be used to steal your identity, which could then lead to financial theft.