Imagine this: you’re sipping coffee on a Saturday morning, checking your online banking app and spot a transaction you don’t recognize. Your heart skips a beat. How did this happen?

October is Cybersecurity Awareness Month, and with Fraud Awareness Week right around the corner in November, there’s no better time to strengthen your online banking habits to help prevent scenarios like the above from happening to you. Being aware of the scams fraudsters are using and implementing tips and tools to help protect your personal and financial information are the first steps in online banking fraud prevention.

Understanding Online Banking Fraud

Online banking fraud can take many forms like fake emails (phishing), counterfeit websites, phone calls or texts from fraudsters impersonating your bank, or even someone guessing your password. Once criminals gain access, they may try to transfer money, make purchases or steal your identity.

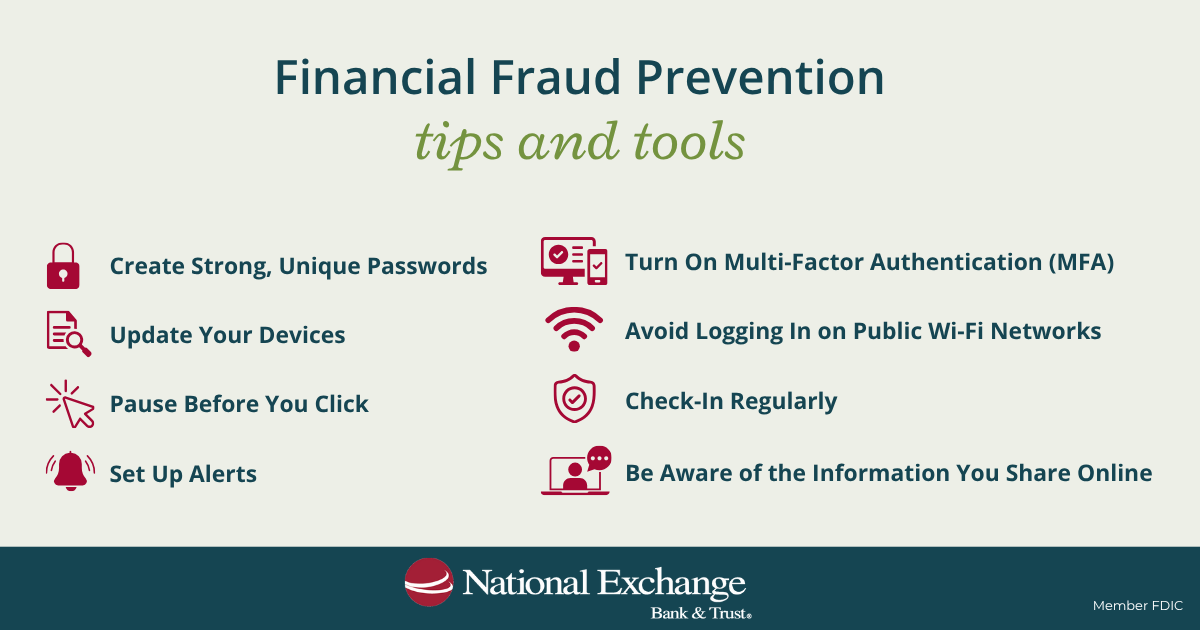

Financial Fraud Prevention Tips and Tools

Think of fraud prevention like locking the doors to your house. It’s simple, but it makes a big difference. Here are some tips and tools to help keep your financial and personal information safe:

-

Create strong, unique passwords. Avoid birthdays, pet names or anything easy to guess. A password manager can help you generate and remember stronger passwords.

-

Be aware of the information you share online. The ‘just for fun Q&As’ you see online often are hidden scams as they ask questions that line up with passwords, password hints or the verification questions many websites offer.

-

Turn on multi-factor authentication (MFA). This extra step, like getting a text code to confirm your login, adds a second lock to your “digital front door.”

-

Pause before you click. If an email or text asks you to “verify” your account or share personal details, stop and double-check. National Exchange Bank & Trust will NEVER ask for this information.

-

Set up alerts. Get notifications based on different activities (general alerts, account specific information and transfers) according to your preferences.

-

Update your devices. Those little “update available” reminders on your phone and computer? They’re important. Updates often patch security holes fraudsters could exploit.

-

Check in regularly. Reviewing your account activity often can help you catch something unusual before it snowballs into a bigger problem.

-

Avoid logging in on public Wi-Fi networks. Public Wi-Fi such as in coffee shops, airports, or hotels, isn’t always secure. Waiting until you’re on a secure, private network helps keep your banking details safe.

Card Controls & Fraud Resources

At National Exchange Bank & Trust, we use a variety of software and industry-related tools to combat fraud, but the most powerful protection comes from working together.

- Card Controls in Exchange Online allow you to quickly and easily block your card(s) as needed or set controls based on location, transaction limits, transaction types or merchant types.

- Card Alerts in Exchange Online allow you to get alerts for all transactions or transactions specifically based on locations, dollar limits, transaction types or merchant types.

- Our Fraud Information page can help keep you up-to-date with resources to combat fraud because your personal and financial information safety is our top priority.

What to Do If Fraud Happens

Mistakes happen, and fraudsters are clever. If you suspect something is wrong:

- Contact your local NEBAT office immediately.

- Report the incident to your local authorities and the FTC.

- Change your online banking password right away.

- Keep monitoring your accounts and credit reports.

Prevention of financial fraud isn’t about living in fear; it’s about being prepared. By combining fraud prevention tips with the security tools your bank provides, you can enjoy the convenience of online banking without the worry. At National Exchange Bank & Trust, we’re always here to help you safeguard your personal information. Visit our Fraud Information Page to stay informed about current scams and access helpful tools to protect yourself.

Fraud Resources Cybersecurity Tips Protect Personal Information Online From Hidden Scams

FAQ’s

What is the primary cause of online financial fraud?

Fraudsters can obtain access to personal or financial information via phishing emails, counterfeit websites, phone calls or texts that impersonate your bank, or even someone guessing your password. Once they gain access to the sensitive information needed, they may try to transfer money, make purchases or steal your identity.

Can someone withdraw money with direct deposit info?

When you sign up for direct deposit, you’re only allowing money to be deposited into your account. The information you provide cannot be used by the payor to withdraw funds.

What are the 4 Ps of spotting fraud?

The Social Security Administration (SSA) highlights four key signs to help you spot a scam, known as the “Four Ps”: Pretend, Problem, Pressure, and Pay. Scammers often pretend to be from a trusted organization to gain your confidence. They create a problem, such as claiming there’s an issue with your account. Then, they apply pressure, urging you to act quickly before you have time to verify the information. Finally, they demand payment, often through unusual methods like gift cards, wire transfers, or cryptocurrency.

What are common financial fraud types?

Some of the most common types of financial fraud and scams include blackmail scams, charity scams, debt collection or relief schemes, foreclosure relief scams, lottery or prize scams, mortgage closing scams and romance scams.

What are common payment methods used by scammers?

Scammers use many different methods to try to take your money including wire transfers, money transfers, peer-to-peer (P2P) and mobile payment apps, gift cards and cryptocurrency.