Housing Market Outlook - 2024

| Posted in News, Home Loans

Is the housing market outlook ever not a topic of discussion? Congratulating those who purchased in the past year, sympathizing with those still in the thick of it, discussing home projects, and so much more. As we start another great year of NEBAT helping customers get into their dream homes, we’re looking ahead to what’s in store for 2024.

Housing Prices in 2024

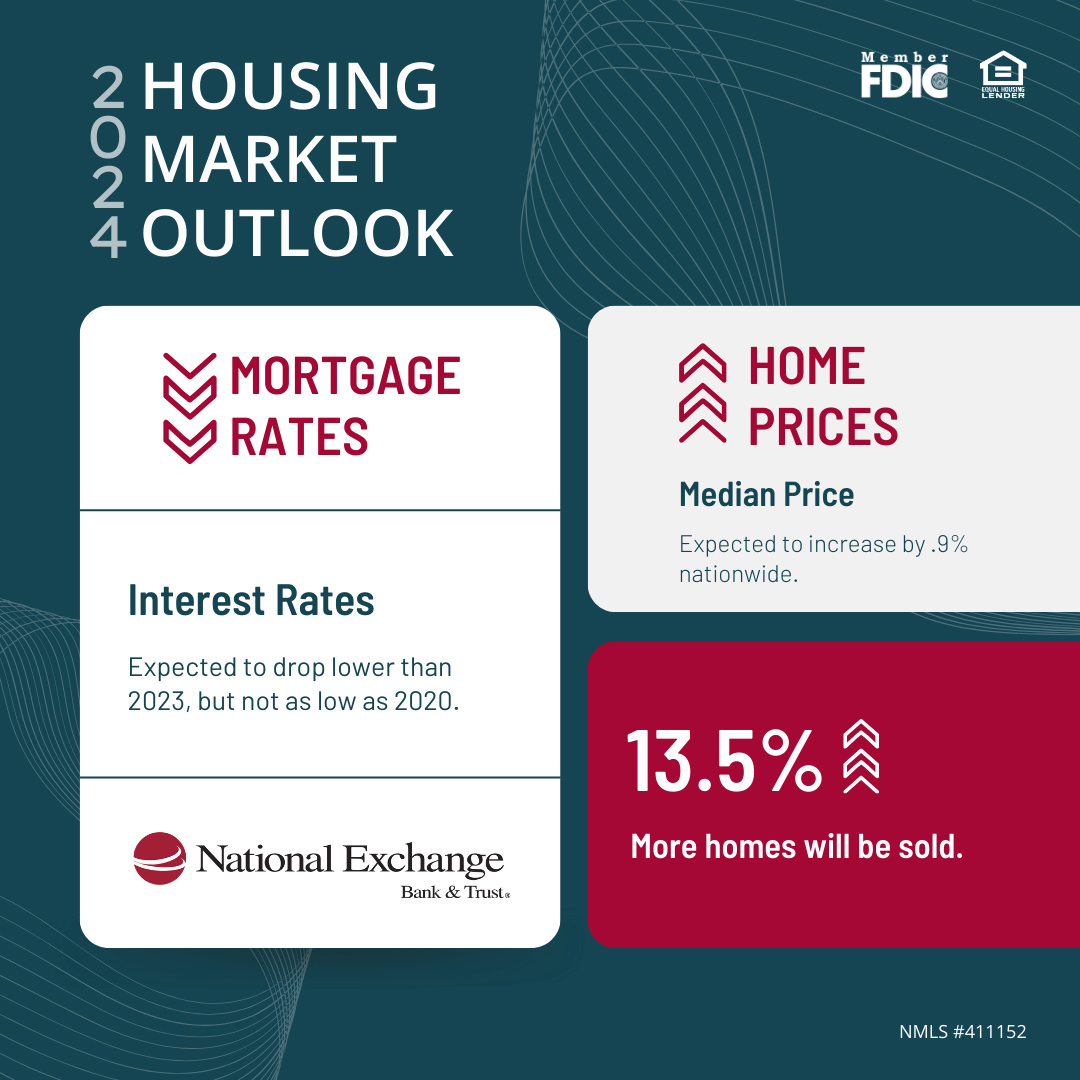

Before we get into mortgage rate predictions, let’s start with estimates for housing prices for 2024. It is estimated that home sales will increase ~13.5% and the median home price will increase by ~.9%. Now, this is a nationwide average. Keep in mind that our markets in Wisconsin are not as highly sought after as areas like Dallas or Nashville; these sought after areas are likely increasing averages. While we do expect home prices to rise (like they do year-after-year), it may not be as high in our cheesehead state as other areas in the country with more demand.

Mortgage Rate Outlook 2024

While our lenders don’t have a crystal ball to see into the future, they are known for watching trends in the market and can give a pretty accurate prediction of the mortgage rate outlook for 2024. What we’re seeing is that rates will drop slightly in 2024. Now, we won’t see the rates that we did back in 2020, but they will likely be lower than we saw in 2023. This is great news for potential home buyers!

While low interest rates like we saw in 2020 would be very exciting, keep in mind the pitfalls. Low mortgage rates = more buyers = more competition. This usually means higher home prices and offers above asking price since this causes a seller’s market1.

While a lower rate equals a lower monthly mortgage payment2, you may be paying well over the value for a home. This strategy may get you an accepted offer, but keep in mind that whenever you require financing, your appraisal3 will need to align with your offer. In addition to this, we always recommend paying what a home is worth, so you start to gain equity4 faster.

Should I Buy a Home in 2024?

If you’re in a place in your life that you’re ready to buy a home both mentally and financially, then we say go for it! Historically, home values appreciate5 over time, so buying now may be a good financial decision to build wealth. Some potential buyers are really holding out for mortgage rates to drop to what we saw in 2020, but it’s extremely unpredictable if or when that will happen. Buying now allows you to start building equity now, and you always have the opportunity to refinance6 to a lower interest rate in the future. Overall, the housing market outlook for 2024 is looking promising for potential homebuyers!

Looking for a place to start? Reach out to your local lender and set up some time to talk about first steps. We do this every day, and we’ll know the direction to send you in.

Notes:

- Seller’s Market: When there is more demand for homes, than homes available, the market is in favor of the home sellers. This could mean more competition on the buyer’s side of the equation, or even increased property prices.

- Mortgage payments: The amount you owe towards paying off your mortgage each month.

- Appraisal: An appraisal is a written document that shows the estimated value of a property based on a number of factors.

- Equity: Equity is the amount your property is currently worth minus the amount of any existing mortgage on your property.

- Appreciate: An increase in value over time.

- Refinance: Mortgage refinance is when you take out a new loan to pay off and replace your old loan.