Scammers Are Using AI to Their Advantage

| Posted in News, Security & Fraud

Your grandma is enjoying a quiet Saturday morning sipping coffee when the phone rings. It’s from one of her favorite grandsons. He is in jail and needs her to send money. She questions this at first… none of her grandchildren would ever do anything to land them in jail! The voice sounds exactly like him though and she will do anything to help, so she gets the information and sends over the requested $10,000 for him to be released. Grandma then picks up the phone to call his mom and tell her she helped him! However, his mom sadly responds, “we’re having lunch together right now, he is not in jail.”

Unfortunately, these scenarios happen as scammers are now using AI to trick their victims into believing they are who they say they are.

Scammers Using AI to Sound Like Family

The example used above is unfortunately all too common. Scammers use artificial intelligence to gather audio data from an individual from somewhere as simple as a video from social media. They are then able to train their AI system to be able to speak exactly like this individual while gathering information about you and contact information of people you know.

If you ever receive a phone call like this and you’re unsure if it’s true, hang up the phone right away. Then call the individual, or anyone else close to them, using known contact information to validate their claim.

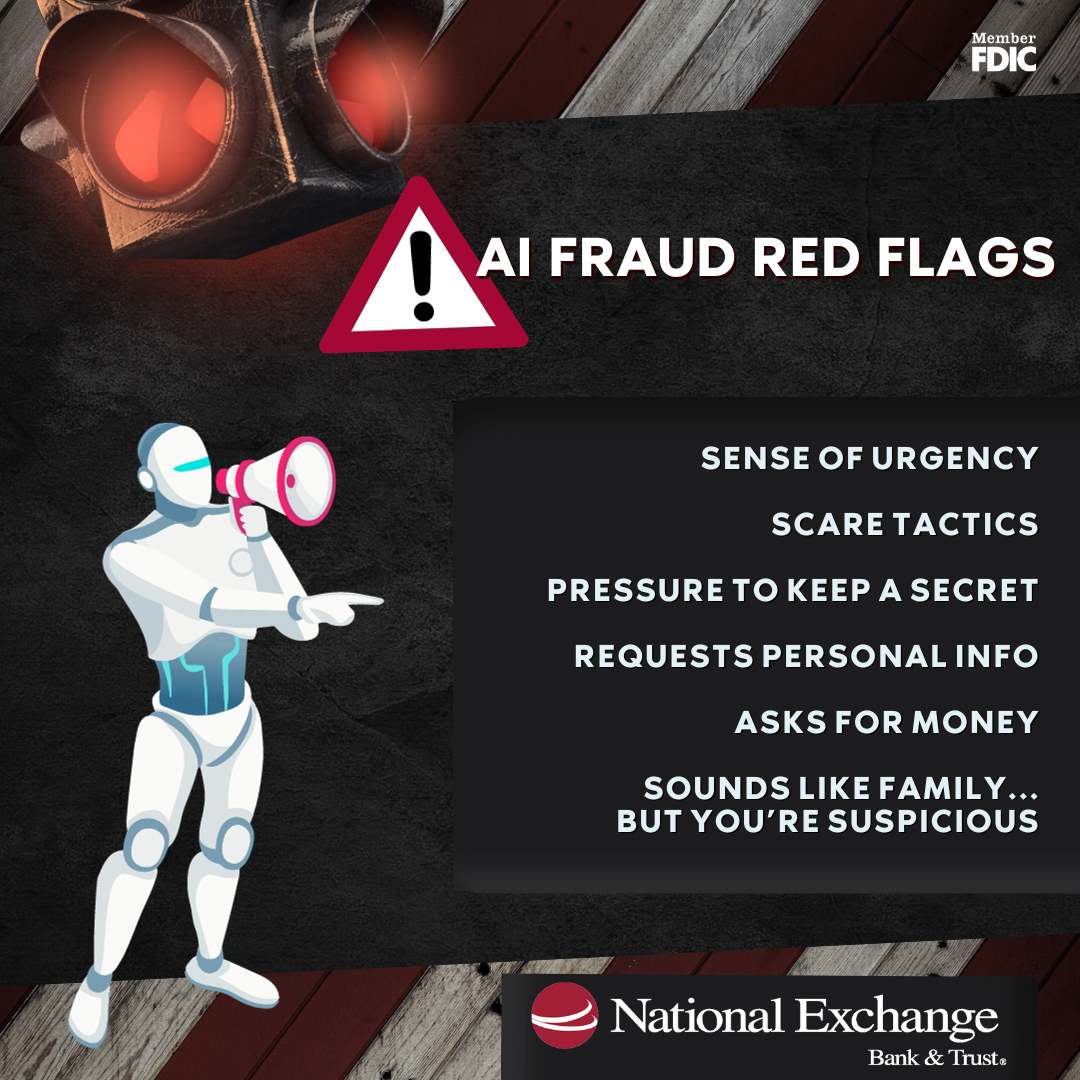

AI Fraud Red Flags

Beyond scammers using AI to sound like family, scammers are using AI to quickly pull information from social media or other online sources. They can then use this information to personalize scam texts, emails or other forms of communication to make them sound more convincing. It is important to recognize these fraudulent attempts right away. Here are a few things to look out for:

- Sense of urgency

- Scare tactics

- Pressure to keep a secret

- Request for personal information

- Ask for money and demands staying on the phone with the scammer until the money has been sent

- Anything that sounds too good to be true

We know scammers are hard to recognize, so if you’re ever in doubt, ask someone you trust for a second opinion. Should there be an issue, contact your bank, credit card company or money transferring app right away to try and recover any lost funds.

AI Fraud Prevention

Scammers will do anything they can to get what they want. However, there are things you can do to mitigate threats:

- Never share personal information with anyone, especially with those whom you do not know personally.

- Keep social media accounts as private as possible.

- Use strong passwords.

- Don’t open emails, answer phone calls or click on links from individuals you do not know.

We recommend always using caution when it comes to sharing personal information. If something feels off, trust your gut and get a second opinion from someone you know and trust.

If you need additional help on navigating the complications of fraud, check out the resources below.

Additional Fraud Resources

Resource: Fraud Information

Blog: Protecting Your Loved Ones from Elder Financial Exploitation

Blog: Recognizing Text Fraud