How to Recognize Text Fraud

| Posted in News, Security & Fraud

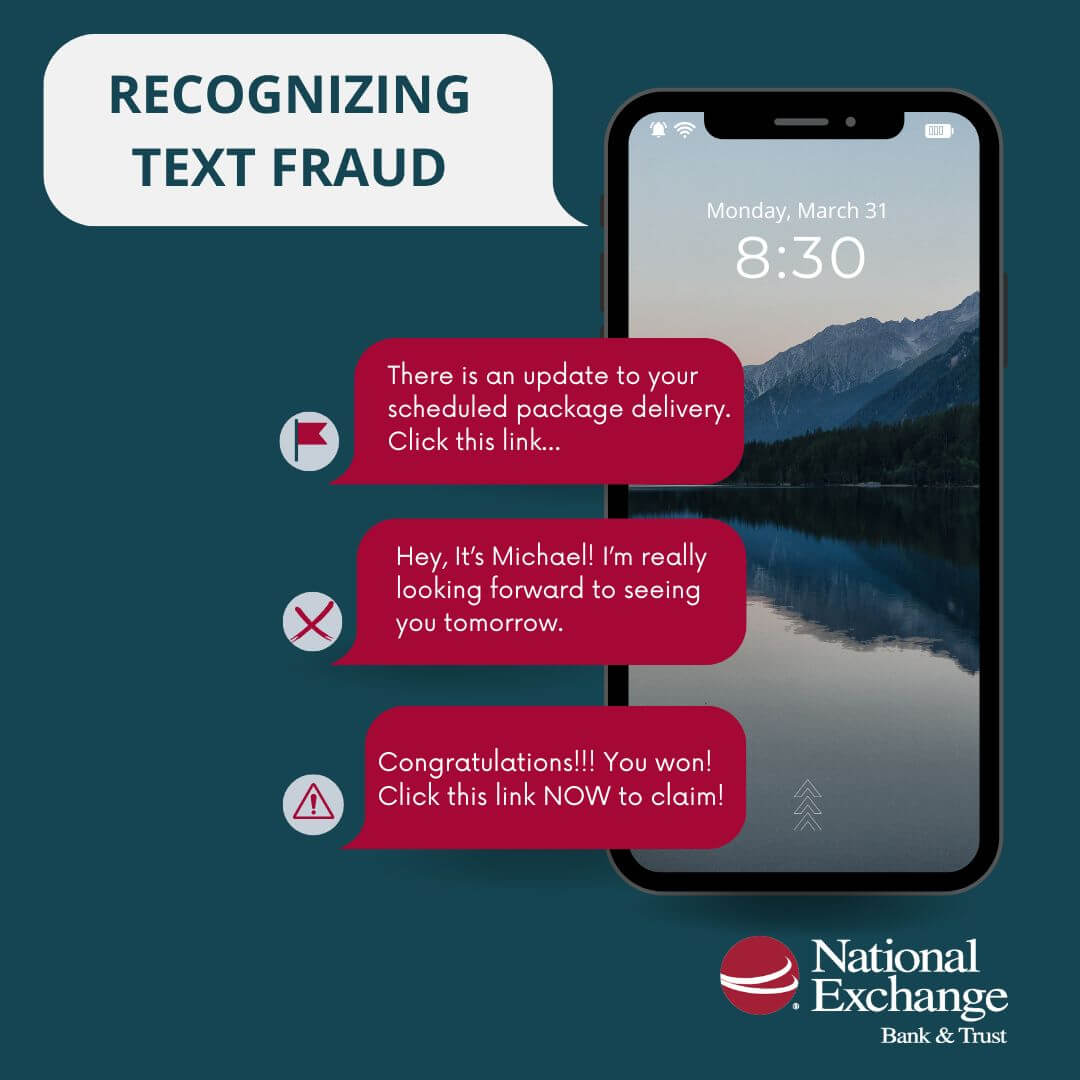

*ding* “There is an update to your scheduled package delivery. Click this link…” Hmmm, but I just looked at my Amazon account today, and my package is already out for delivery.

*ding* “Hey, It’s Michael! I’m really looking forward to seeing you tomorrow.” I don’t know Michael, and I’m definitely not seeing him tomorrow, he must just have the wrong number.

*ding* “Congratulations!!! You won! Click this link NOW to claim your prize!!” Nice try, scammer.

*ding* “This is National Exchange Bank. There is a problem with your account, and we need you verify your information.” What? My bank would never ask me to send account information to them via text!

As if we don’t have enough scams in our world today, text fraud is becoming increasingly popular, to the point that it has its own name, Smishing (SMS phishing). Some of these fraudulent text messages we can spot immediately, and some seem almost too real. At National Exchange Bank & Trust, our goal is to educate our customers to help them understand current scams so that they can protect themselves from scammers, no matter how they get a hold of us. So, let’s dive in on what to look for when it comes to text fraud.

Examples of Fraudulent Text Messages

When you think of text scams, you may think of texts that seem obvious, such as:

- Texts with overuse of punctuation.

- Texts with suspicious links.

- Texts from international phone numbers or email addresses.

- Inappropriate messages.

However, scammers are getting smart, and will send messages that seem fairly normal, such as:

- A text message about your debit card from your bank.

- An update on your package delivery.

- “Verify your account by clicking this link.”

- “You’ve won!”

- A message stating a family member needs help.

- A text that seems like it is coming from someone who has the wrong number.

- Text messages from a government agency. Note: the government will not communicate via text message. This type of fraud becomes increasingly popular during tax season.

- Persuasive messaging or messages with a strong sense of urgency.

SoS Daily News also reported a single word text such as “Hi” or “Help” is another form of smishing to get you to think the message is a friend or family member.

Needless to say, if you ever receive a message from an unknown number, it is best to proceed with caution to keep yourself safe from fraudulent text messages.

What to do if You Notice Text Fraud

Now that you know what to look for, what do you do if you receive a fraudulent text message:

- Now that you know what to look for, what do you do if you receive a fraudulent text message:

- If you feel your safety is at risk, report it to your local authorities right away.

- Do NOT reply.

- Inform your carrier of the phone number you received spam from.

- Update your passwords to accounts containing sensitive information that may relate to the message.

- Do not supply any banking information via text. For more resources on information banks won’t ask for, check out Banks Never Ask That. Knowing what your bank will never ask for will help you recognize scams quickly. Promptly block the phone number.

- Do NOT click on any links.

Tips for Avoiding Fraudulent Text Messages

There may not be a way to avoid fraudulent text messages completely, but there are some ways to try and mitigate them.

- Opt out of text marketing. This information is sometimes sold to third-parties, leading to fraud. If there’s a list you want to join, make sure it is from a company you trust with your information.

- Remain cautious about who you give your information to. This could be online forms or purchases or even other individuals.

- If your phone allows, filter out potential spam texts from unknown senders.

- Continue ignoring and blocking spam phone numbers or emails.

Scammers will try nearly anything to obtain your information. They are getting smarter, but we can outsmart them. To stay up to date on current scams as well as tips to avoid them, visit our fraud information page.