Saving for College Education

| Posted in News, Financial Education

Discovering the best way to save for college can be overwhelming. Different savings plans work best for different families, so it is important to learn about different options and choose which is best for you! NEBAT offers flexible college savings options to help you plan!

When to Start Saving for College

Saving for college education is something to start considering early on. The cost of college has grown significantly over time. Although different institutions, levels of education, and living arrangements can vary the cost of education, prices continue to increase each year. The sooner you can start saving, the better off you’ll be when move-in day comes. Thankfully, there are many college savings solutions available to allow you to save in a way that works best for you.

How To Save Money for College

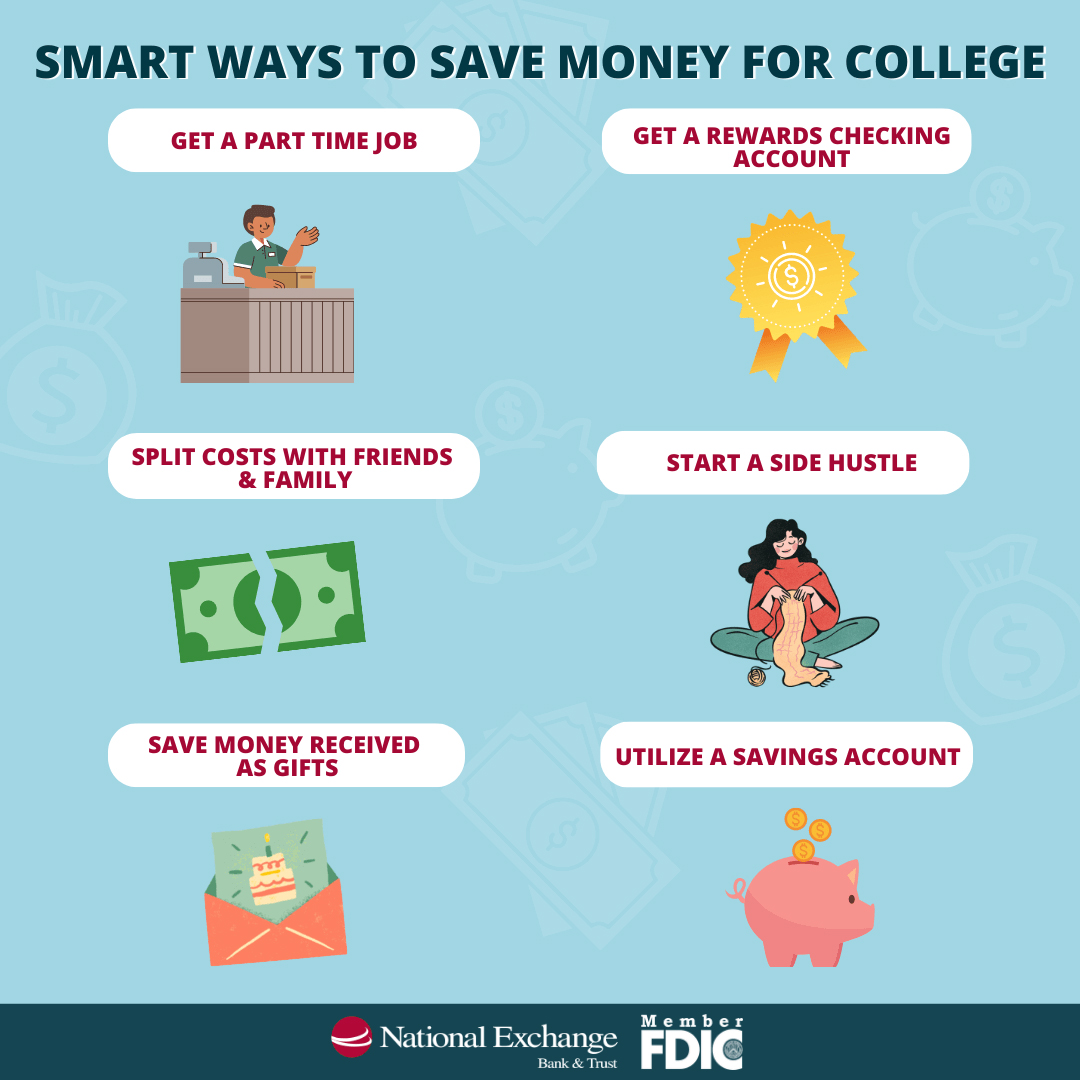

While college is an investment in time and money, the result of having a rewarding career will pay off in the long run. Here are a few various college savings options:

- Take AP or dual-credit classes in high school to potentially earn FREE college credits.

- Get a part-time job and set aside a percentage of each paycheck for your college fund.

- Start a side hustle to earn extra cash.

- Save the money you receive as gifts. (Bonus tip: ask for money for your college fund instead of gift cards.)

- Split costs with friends and family members for expenses such as subscriptions and gifts.

- Utilize bank savings accounts. NEBAT’S Steps Savings account is designed for children, teenagers and young adults. Account holders earn a preferential interest rate!

- Earn rewards with your own checking account. NEBAT’s Step-Up Checking accounts rewards you for making good financial choices. Plus, you can make mobile check deposits to access funds received in a paper check by snapping a quick pic.

- Consider a 529 Plan

How Much Do I Need to Save for College?

Having a plan on how to save money for college early is crucial to limit the amount of student loan debt you will have and the unavoidable interest that comes along with it. One of the first questions you should ask yourself is: “How much do I need to save for college?” This will depend on your individual goals including your desired career path and what college or university you plan to attend. According to the National Center for Education Statistics, the average 2021-2022 tuition and fees for full time students at 4-year non-profit institutions was $55,800, private for-profit institutions was $32,900, and public institutions was $26,000. This is in addition to the cost of living, textbooks, technology and other school supplies.

Dollars for $cholars Program

NEBAT’s program is one of the most popular college savings options. The program offers your family the option to set aside money from birth to age 25 to save for a college education. Its flexibility allows you to renew the 3-year CD, invest in another account at the end of 3 years, or use funds immediately for educational purposes. Plus, withdraw up to 4 times per year for school expenses! This could include funds for tuition, books, technology or additional school expenses.

College Scholarships

College scholarships are a great way to alleviate costs for college and for the student to contribute to the cost of their education, without having to pay the money back. NEBAT offers the Step-Up Scholarship which is open to any high school senior or college undergraduate student through age 25 that has a Dollars for $cholars or Steps account. A scholarship is awarded to one high school graduating senior and one student continuing their college education. Applications typically open around January each year and are available on the Step-Up page of our website.