Get Started

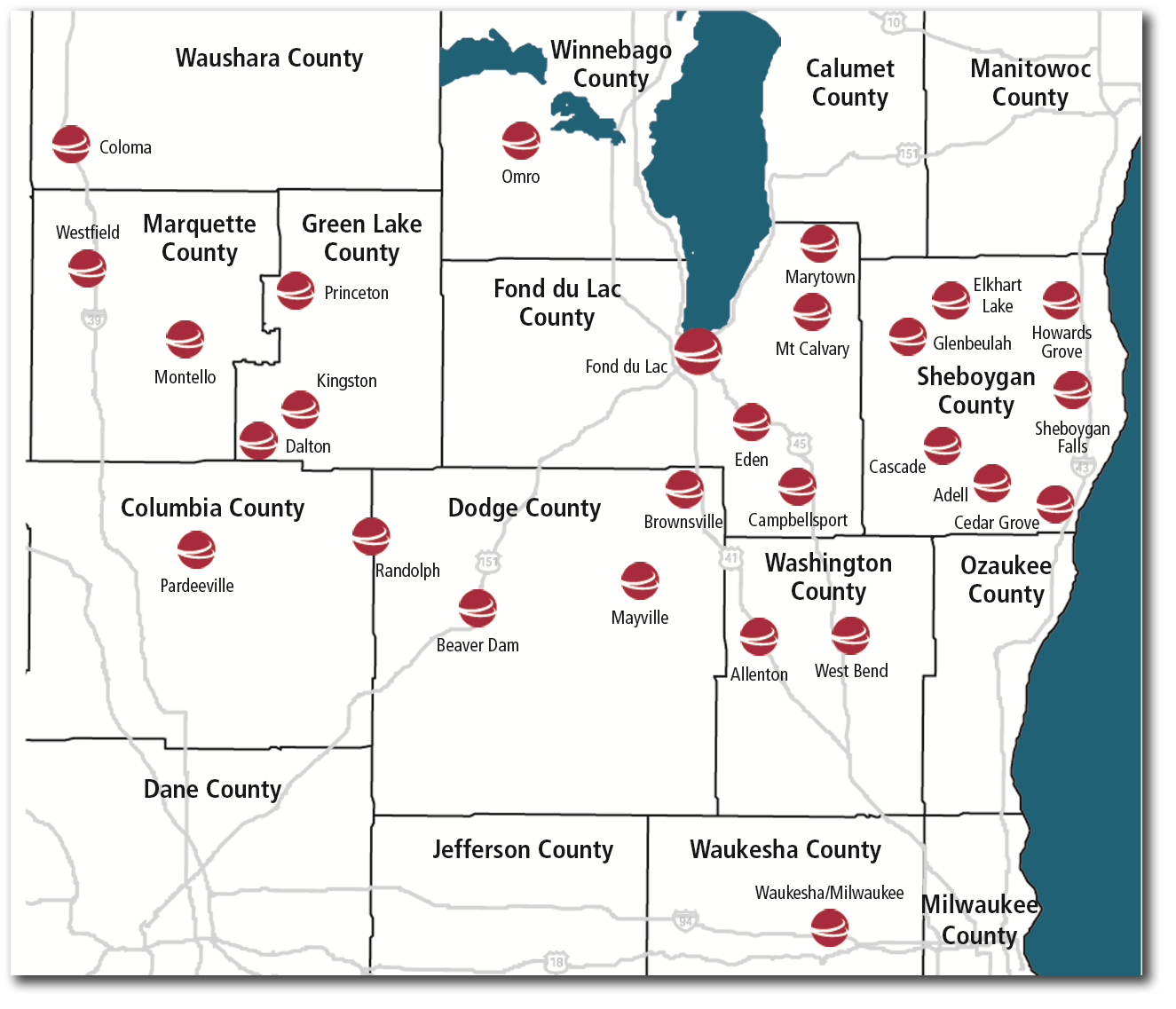

Which NEBAT office is closest to you?

View the map, then find your closest office listed with a specific territory. Click the button for the territory to connect with a NEBAT lender that specializes in Condo Loans!

Territories

Coloma, Pardeeville, Randolph, Westfield

Territory A

Dalton, Kingston, Montello, Princeton

Territory B

Waupun

Territory C

Beaver Dam, Brandon, Brownsville, Mayville, Rosendale

Territory D

Campbellsport, Eden, Fond du Lac, Omro

Territory E

Chilton, Marytown, Mt. Calvary

Territory F

Adell, Cedar Grove, Elkhart Lake, Howards Grove, Sheboygan Falls

Territory G

Allenton, West Bend, Waukesha

Territory H

How Can I Use the Single Family Guaranteed Loan?

The loan can be used for a variety of items. These include but are not limited to:

- New or existing residential property to be used as a permanent residence.

- Repairs and restoration used with the purchase of existing housing.

- Special design features and permanently installed equipment to help one with physical disability.

- Reasonable and customary connection fees, assessments or the proportional installment cost for utilities such as water, sewer, electricity and gas for which the buyer is liable.

- A proportional share of real estate taxes that is due and payable on the property at the time of loan closing. Funds can be allowed for the establishment of escrow accounts for real estate taxes and/or hazard and flood insurance premiums.

- Essential household equipment such as wall-to-wall carpeting, ovens, ranges, refrigerators, washers, dryers, heating and cooling equipment as long as the equipment is conveyed with the housing.

- Purchasing and installing measures to promote energy efficiency (e.g. insulation, double-paned glass and solar panels).

- Installing fixed broadband service to the household as long as the equipment is conveyed with the housing.

For more information on how the loan can be used and to learn if you're eligible visit USDA's website.