Using a HELOC for Fall Home Upgrades

| Posted in News, Highlighted Posts, Home Loans

As energy costs continue to rise, homeowners are feeling the strain on their monthly budgets. Investing in energy-efficient home upgrades not only helps reduce utility bills but also increases a home's value and comfort. One smart way to fund these projects is through using a home equity line of credit (HELOC). Using a HELOC for home improvements allows homeowners to tap into their home’s equity, providing financing to make a home more energy-efficient while saving money in the long run.

Understanding a HELOC For Home Improvements

A home equity line of credit is a flexible financing option that allows homeowners to borrow against the equity they’ve already built in their home. It works much like a credit card, offering a revolving line of credit that you can draw from as needed, typically with a variable interest rate. One of the major advantages of using a home equity line of credit for home improvements is its lower rate compared to most credit cards. The rate is lower, because it is a secured loan, using the equity in your home as collateral. However, it's important to note that missing payments could put the property at risk. To qualify for a HELOC, a strong credit score, sufficient equity in the home, and a stable income is generally needed.

Fall Into Savings with These Energy-Efficient Home Improvements

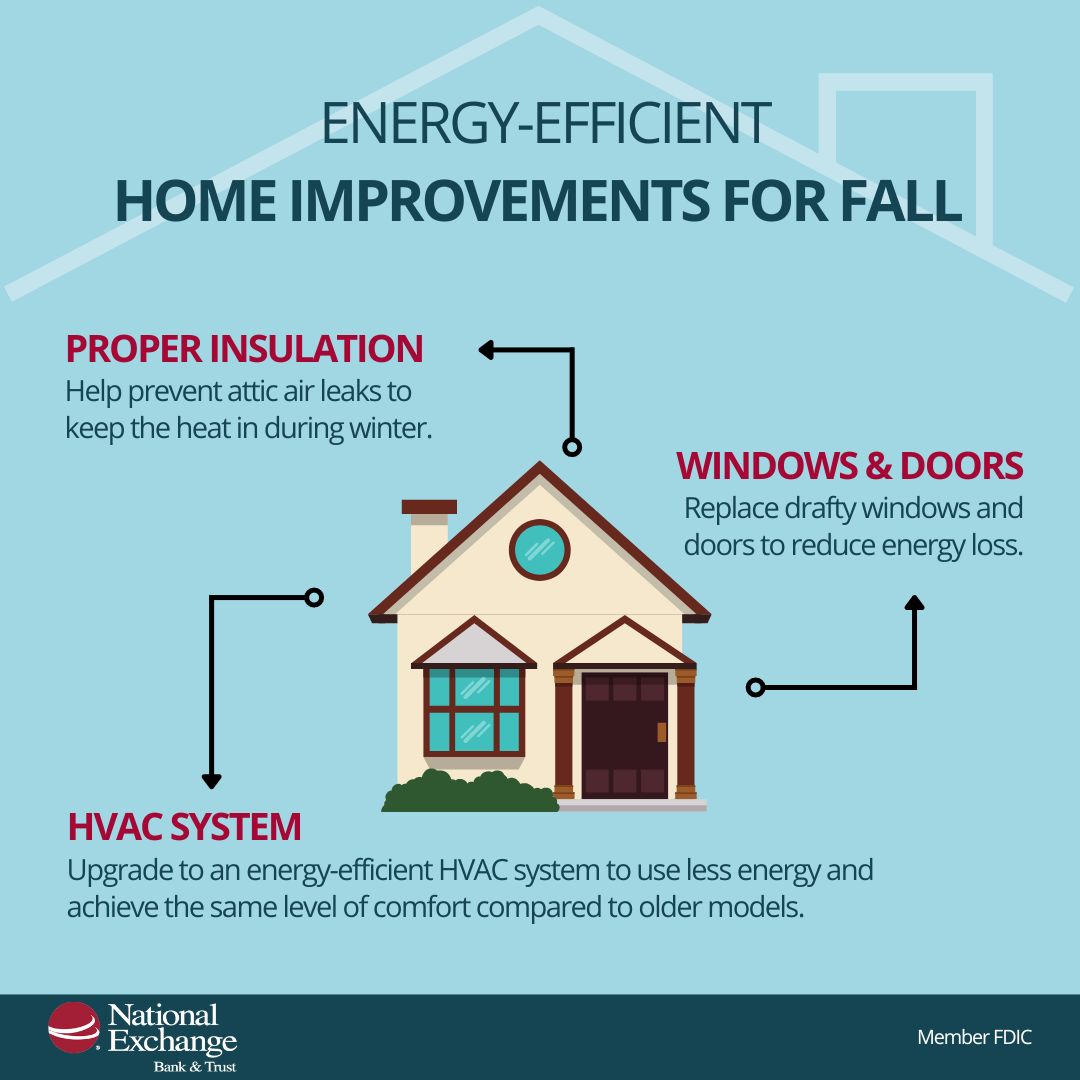

Fall is an ideal time to prepare homes for winter by investing in energy-efficient upgrades. Here are some of the most impactful home improvements a home equity line of credit can be used towards:

Insulation: Don't let hard-earned cash slip through the cracks. Proper insulation helps prevent attic air leaks to keep the heat in during winter.

New Windows and Doors: Replace those drafty old windows and doors with energy-efficient models. Modern windows and doors often feature multiple panes of glass, reducing energy loss. Additionally, improved seals and weatherstripping prevent drafts, keeping homes more comfortable.

HVAC Systems: Newer, energy-efficient HVAC systems incorporate the latest technology and design improvements to optimize energy. Modern HVAC systems often use less energy to achieve the same level of comfort compared to older models. Additionally, upgrading to a more energy-efficient HVAC system may qualify homeowners for various rebates and tax credits.

Using a HELOC

Using a HELOC for energy-efficient home improvements, such as upgrading your windows, insulation, and HVAC system, offer substantial benefits including reduced utility bills, increased comfort, and enhanced property value. Utilizing a home equity line of credit for home improvements can be a smart way to fund these upgrades, providing flexible financing while leveraging the equity in your home. Given the current market's potential for increased home equity, now is an excellent time to apply for a home equity line of credit and start planning your home improvement projects for fall.

Get started by applying online today or contact us for more information.