Protecting Personal Information from Hidden Scams

| Posted in News, Security & Fraud

Social media is a blessing and a curse. We love scrolling our newsfeed to see our friend’s newest engagement photos, photos of our sweet nieces and nephews, and let’s not forget the funny photos and videos we stumble upon. Then there are posts that catch our attention in a different way… we’ve all seen it. You’re scrolling social media and see a friend post “Just for fun, answer this Q&A” or “Ask your spouse these 10 questions and post their answers.” Sometimes it’s the “Copy and paste this private message and send it to 5 friends.”

Believe it or not, it’s these posts that lead users down the path of giving away personal information in sneaky social media scams.

Think about the passwords you have. Now, think about the Q&A social media posts you see with questions like “What is your pet’s name?” or “When is your anniversary?”

These questions often line up with passwords, password hints, or the verification questions many websites offer to help stay secure. Scammers will snatch this information right up.

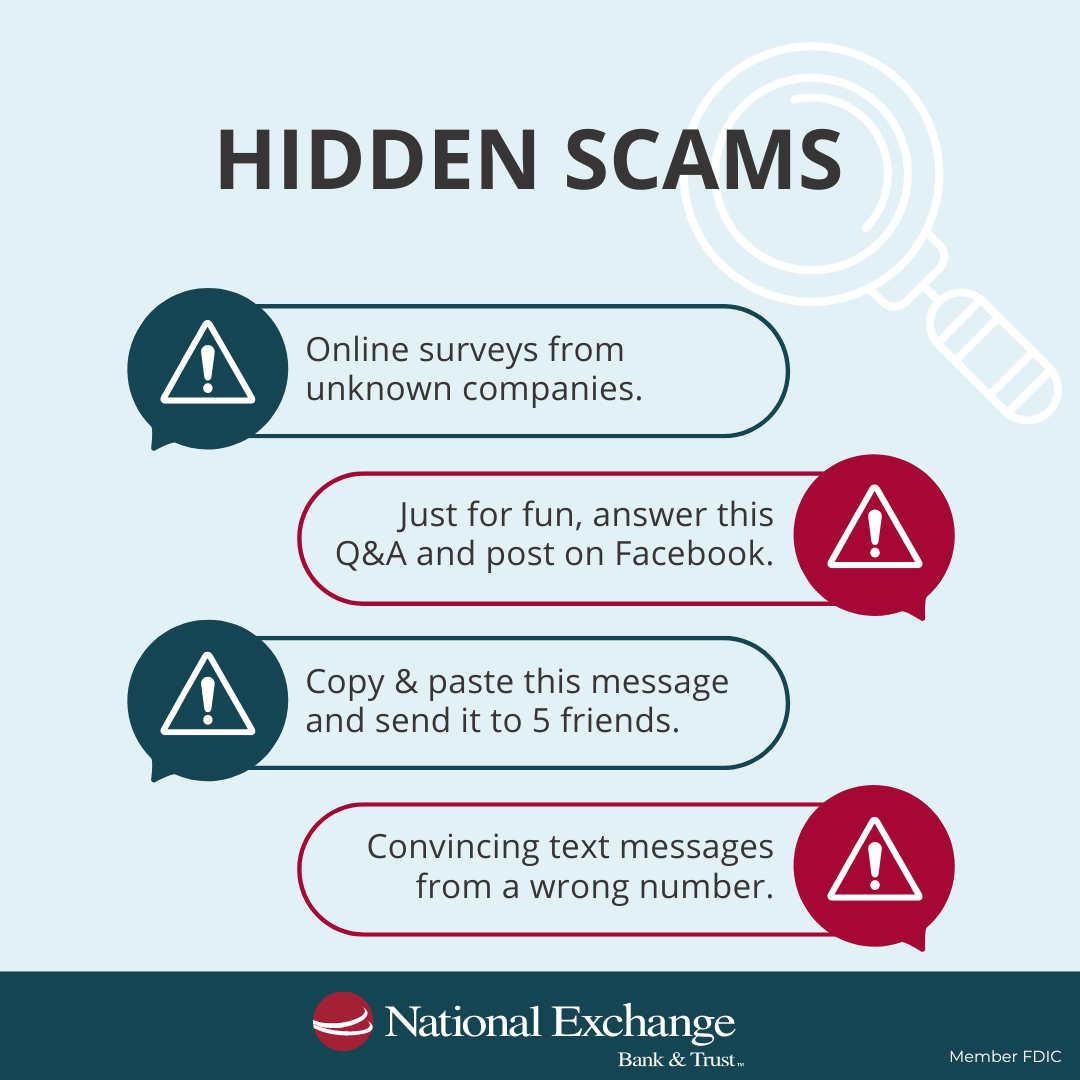

Hidden Scams

Social media scams cover just some of the hidden scams out there. Scammers will find any way they can to take your information.

Here are a few scams that may seem less obvious than ones you may have heard of:

- Posting back to school photos with details of your child’s age, school, teacher, etc. should be avoided to protect you and your child. Instead, just keep it simple! The less personal information the better.

- Never accept friend/follower requests from people you don’t know. Protecting personal information means keeping online accounts as private as possible.

- Be careful of text messages from a stranger that seem to just have the wrong number. It may feel like you’re being friendly saying “Sorry, you have the wrong number” but this simple gesture could unfortunately lead to trouble.

- Avoid any kind of online survey from unknown websites. It’s fun to take all the online personality quizzes, but they often ask for personal information. If you don’t know who is collecting the information, stay away!

- Be careful when joining any public WI-FI network. If you’re wanting to connect to the local coffee shop’s WI-FI, just make sure to ask the barista what the network is. Scammers can set up networks that look public, but once you’re connected, it is easy for them to steal your information.

- At NEBAT we always support charitable giving, but always make sure you know exactly where your donations are going. Again, if they start asking for personal information, do a bit more research.

Tips to Protecting Your Personal Information

We don’t mean to scare you! We simply share this information to help you be aware of all the sneaky ways scammers will use any tactic to gain personal information. Now that you know what to be on the lookout for, here are a few additional tips to keep your information private:

-

Utilize strong passwords. No two passwords should be the same. A combination of letters, numbers, and punctuation are best. To help remember, you could make up an acronym. NEVER use your eBanking password for any other site.

-

Only give personal information to companies that actually need it. If you’re wondering to yourself “why would they need my date of birth” it’s ok to throw up a red flag.

-

If there is an option to not include certain information, leave it blank.

-

Get a second opinion. It’s easier to ask for help in preventing fraud than asking for help after something terrible happens. Have someone you know and trust be your backup if something seems suspicious.

-

Use Multi Factor Authentication (MFA) whenever possible. You can receive an email or text message with a code to verify your account or use an authenticator app.

-

If you ever have a code sent to you when you are not trying to log in, change your password! This means that someone else is trying to log into your account.

-

As always NEBAT is here to help keep you protected. We keep our Fraud Resource Center up to date on current scams and other resources to keep you protected.